Published 22:13 IST, February 23rd 2024

Even as arrivals near 2019 levels, casino stocks have yet to recover their pre-Covid lustre.

Advertisement

Golden time. Tens of thousands of Chinese tourists descended on Macau to ring in the Year of the Dragon over the Spring Festival. But even as arrivals near 2019 levels, casino stocks have yet to recover their pre-Covid lustre.

The recent holiday, extended to as much as 10 days by some mainland employers, saw Macau return to something resembling its pre-pandemic glory. The city welcomed roughly 170,000 visitors a day from Feb. 10 to 17, just shy of the 2019 holiday average, official data showed. Many Chinese vacationers eschewed pricey overseas jaunts for destinations closer to home, and those who travelled domestically spent less per trip this year. But Macau’s visitors were readier to open their wallets. Analyst DS Kim at JPMorgan estimated mass market gambling revenue was more than a fifth higher than the 2019 festive season.

Advertisement

That builds on an encouraging fourth quarter. Total money wagered per visitor surpassed pre-pandemic numbers by 20%, according to government statistics, helping Wynn Resorts, Las Vegas Sands and MGM Resorts International reverse the losses reported a year earlier. MGM China increased adjusted earnings before interest, taxes, depreciation, amortisation and rent-related costs to $262 million in the three months to December, more than 40% above the same period in 2019.

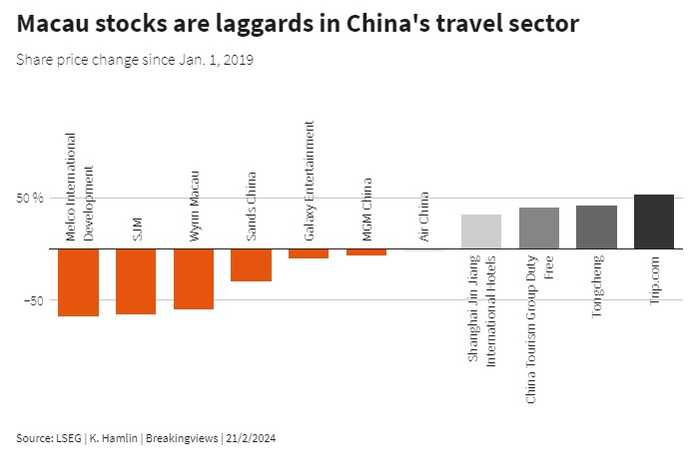

However, the six listed casino operators’ enterprise values are on average worth only around 10 times estimated EBITDA for 2024, per LSEG. That compares with multiples in the mid-teens before Covid-19 struck. Share prices remain far off 2019 levels for all but MGM, at odds with other domestic travel-focused plays: booking specialists Trip.com and Tongcheng , Shanghai Jinjiang International Hotels and China Duty Free have all gained more than a third over the same period.

Advertisement

There are reasons for the disconnect. Macau may be a cheaper and easier holiday spot than say, Seoul or Paris, but it is still pricier than many mainland attractions. Any further economic malaise could undermine willingness to splurge on hotels and baccarat in the casino hub.

Then there is debt. Casino operators took on substantial leverage to avoid layoffs and to re-invest in facilities when Covid controls kept customers away. Improved earnings will help ease interest burdens, but smaller operators SJM and Melco Resorts and Entertainment will still hold net debt equivalent to around five times EBITDA this year, estimates Visible Alpha.

Advertisement

Macau’s out of the cold, but it’s still not exactly hot.

22:13 IST, February 23rd 2024