Published 16:15 IST, May 3rd 2024

Hong Kong’s Hang Seng Index has risen 20% from its recent low in January, supported by substantial purchases from both mainland and global traders.

Advertisement

Looking up. After a $5 trillion fall, green shoots are appearing in Chinese equities: Hong Kong’s benchmark Hang Seng Index is up 20% from its most recent low in January and is gaining momentum. Shares traded on the mainland are up 16%. Unlike previous rallies which quickly fizzled out, these look better supported.

Inflows to both destinations have been prodigious, with offshore investors pouring 22.5 billion yuan ($3.11 billion) into onshore stocks in a single day last Friday. More important than the size of those flows is their composition.

Advertisement

It's not just China's national team of state-owned entities buying. Local traders say global long-only investors are returning to the market at a meaningful scale for the first time since early 2023, when Beijing finally ended onerous Covid-19 restrictions.

There is an external push in China's favour too: falls in U.S. equities spurred by the Federal Reserve's higher-for-longer interest rates and the weak Japanese yen have made cheap Chinese stocks an attractive hedge, both globally and within the region. Chinese shares trade at 9.3 times forward price-to-earnings, half their ratio in 2021, LSEG data shows.

Advertisement

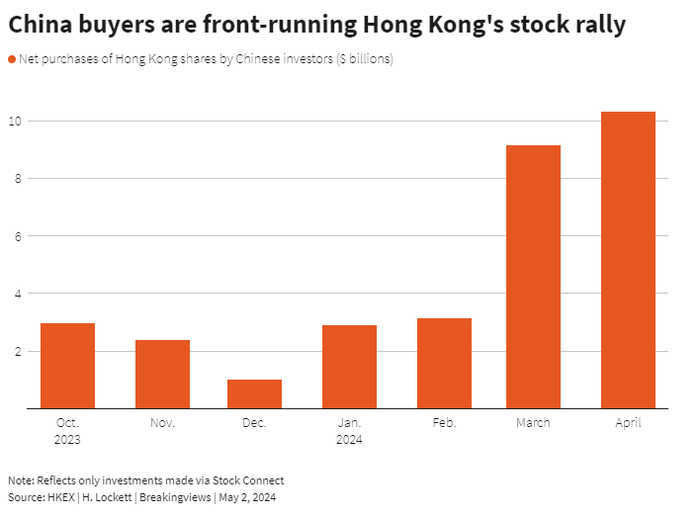

Crucially, fear of missing out on a rebound is also rising. The Hang Seng rally, for example, is driven partly by purchases from mainland investors front-running anticipated foreign buying.

The overall enthusiasm seems rational. China’s securities regulator last month released a list of policy goals for the coming decade prioritising shareholder returns. Officials also announced plans to expand access for mainland buyers to Hong Kong’s market and voiced support for new Chinese listings in the deal-starved city.

Advertisement

Of course, policymakers may yet fail to deliver on those measures. Underwhelming GDP growth or weak earnings performance in the world's second-largest economy also could once again spook foreign fund managers and sap local investors’ animal spirits.

And there is a long way to go. Exposure to China remains light, with average allocations by global equity funds at 1.5% at the end of March, according to fund flow tracker EPFR, almost half the country's weighting in the MSCI All Country World Index . But China stocks are, at least, back on the table.

Advertisement

Context News

Hong Kong’s China-dominated Hang Seng Index has risen 20% from its recent low in January, supported by substantial purchases from both mainland traders and global investors.

16:15 IST, May 3rd 2024