Published 14:54 IST, March 1st 2024

The National Stock Exchange benchmark Nifty 50 index rose as much as 321 points to hit record high of 22,304.

Advertisement

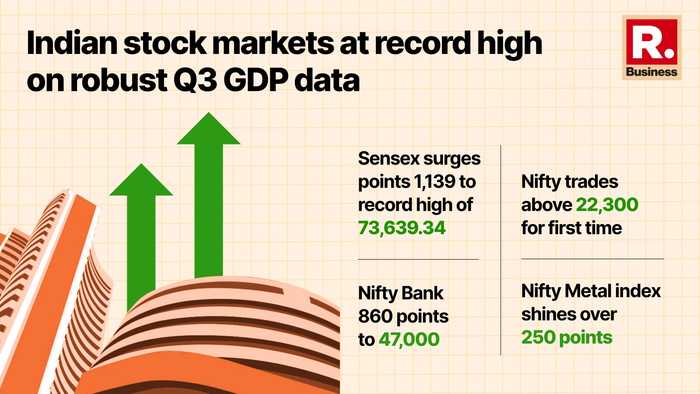

Nifty at record high: The Indian equity benchmarks gave a big thumbs up to December quarter (Q3) gross domestic product (GDP) data released post market hours on Thursday. The National Stock Exchange (NSE) benchmark Nifty 50 index rose as much as 321 points to hit record high of 22,304 and the 30-share Sensex climbed 1,074 points to hit an all-time high of 73,574.02.

Strong Q3 GDP

India's economy remained the fastest growing major economy of the world rising at 8.4 per cent in December quarter surpassing estimates and reiterating investor confidence in India's growth story, analysts said.

Advertisement

"Another stellar quarter of healthy growth prints has been underpinned by strong manufacturing and steady services. Expenditure-side estimates depict healthy gross fixed capital formation (GFCF) and tepid private consumption growth, while government consumption slowed massively. The wide divergence between higher investment vs. lower consumption and moderate exports has been the key highlight of the past year," brokerage firm Emkay said in a note.

“The key surprising factor was 190 basis points (bps) sharp wedge between GDP and GVA growth, which is difficult to fathom. However, on the surface, it largely reflects higher growth in general government net indirect taxes, possibly with lower subsidies. The second estimate for FY24 puts real GDP 30 basis points higher at 7.6 per cent, even as real GVA is unchanged at 6.9 per cent. Interestingly, even as FY24 nominal GDP growth is a tad higher than the first estimate of 9.1 per cent, it is 10 per cent lower in value terms. The implied Q4 GDP/GVA growth print will slow to 5.9 per cent/5.4 per cent, indicating most of the growth moderation is borne by Q4,” Emkay added.

Advertisement

Sectoral picture

Buying was visible across sectors as nine of 13 sector gauges compiled by the National Stock Exchange were trading higher led by Nifty Metal index's over 2.5 per cent gain. Nifty Private Bank, Bank, Auto, Financial Services, Private Bank, PSU Bank and Oil & Gas indices also rose around 1.5 per cent each.

Broader markets were also witnessing buying interest as Nifty Midcap 100 index rose 0.6 per cent and Nifty Smallcap 100 index advanced 0.43 per cent.

Advertisement

Top movers

ICICI Bank, Reliance Industries, Larsen & Toubro, HDFC Bank, Tata Steel and Axis Bank were among the top movers in the Sensex. They collectively added over 500 points gain towards Sensex.

Tata Steel was top Nifty gainer, the stock rose 4.44 per cent to hit fresh 52-week high of Rs 148. JSW Steel, Larsen & Toubro, Hindalco, Titan, ICICI Bank, Bharat Petroleum, Tata Motors, IndusInd Bank and Maruti Suzuki also rose between 2-4 per cent.

Advertisement

On the flipside, Britannia Industries, HCL Technologies, Apollo Hospitals, LTI Mindtree, Sin Pharma, Cipla and Infosys were among the notable losers.

The overall market breadth was extremely positive as 2,460 shares were trading higher while 1,258 were declining on the BSE.

Advertisement

12:15 IST, March 1st 2024