Updated 23 May 2025 at 14:05 IST

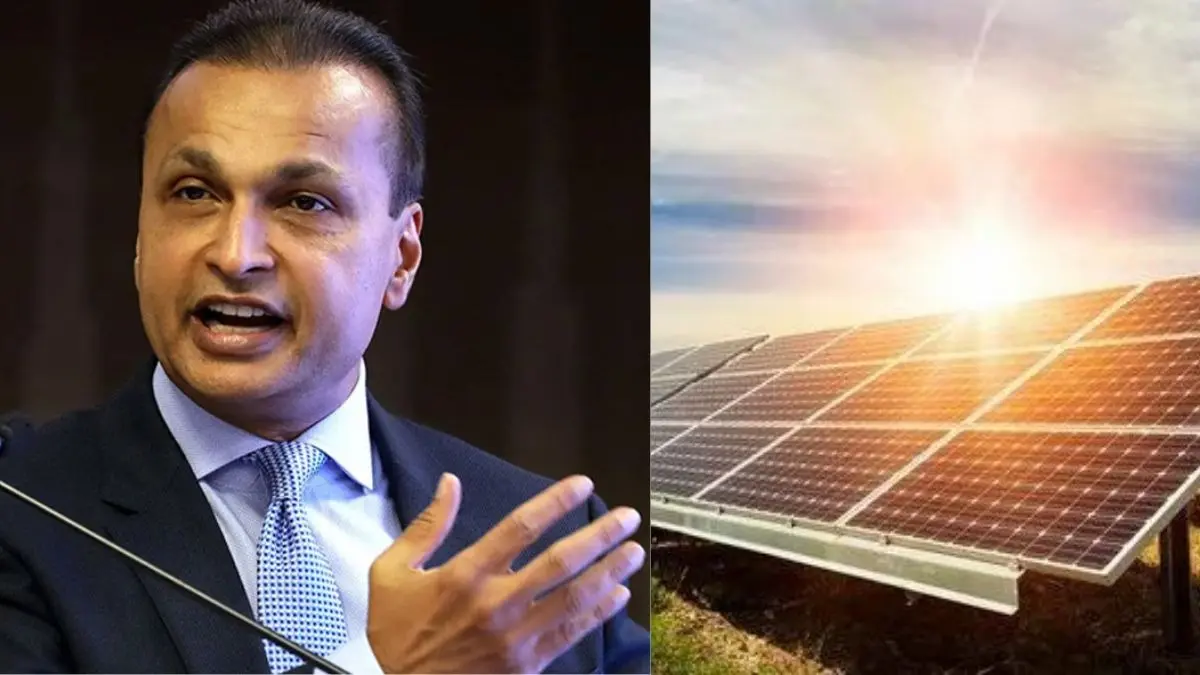

Reliance Power Share Price Surges 19%: Why Anil Ambani’s Company Is Rallying

The shares of Anil Ambani led Reliance Power Ltd surged 18.88 per cent to hit an intra-day high of Rs 53 on the backs of growing demand for this energy stock in both Indian indices.

- Republic Business

- 2 min read

The shares of Anil Ambani led Reliance Power Ltd surged 18.88 per cent to hit an intra-day high of Rs 53 on the backs of growing demand for this energy stock in both Indian indices.

The shares of the company were in great demand, as a total of 24.23 million equity shares worth Rs 120.80 crore changed hands on the BSE, by 1:10 PM. Similarly, 282.43 million shares worth Rs 1,410.25 crore had changed hands on NSE.

This comes after the shares of the company were in demand given 4.23 million equity shares worth Rs 120.80 crore changed hands on the BSE. Following suit, 282.43 million shares worth Rs 1,410.25 crore had changed hands on NSE.

Recently, this Reliance Group subsidiary inked a partnership with Bhutan's Druk Holding and Investments (DHI) to develop Bhutan's largest solar power project in a Rs 2,000 crore joint venture. The 500 megawatt (MW) project will be developed under a 50:50 partnership through a Build-Own-Operate (BOO) model, as per a BSE exchange filing.

Advertisement

"The landmark solar investment in Bhutan underscores Reliance Group's strategic focus on expanding its renewable energy portfolio, while reinforcing its long-term commitment to strengthening India-Bhutan economic cooperation. Reliance Power’s total clean energy pipeline stands at 2.5 gigawatts peak (GWp) in the solar segment, making it India’s largest player in the integrated solar and Battery Energy Storage System (BESS) segment," it mentioned.

Further, the energy-focused firm mentioned that it has commenced, "Engineering, Procurement, and Construction (EPC)tendering process, adhering to international competitive bidding standards to ensure optimal technical execution and cost efficiency. The company has also initiated engagement with leading financial institutions to structure sustainable, long-tenor project finance solutions, focused on optimizing capital structure and enhancing overall financing efficiency."

Advertisement

Reliance Power Q4 FY25 results

The Mumbai-headquartered posted a consolidated net profit of Rs 126 crore in Q4FY25, driven by a major dip in expenses. This marked a U-turn from the same quarter previous year, when the company posted a net loss of Rs 397.5 crore.

Total income in Q4FY25 declined to Rs 2,066 crore, compared to Rs 2,193.8 crore in the corresponding period of the previous year. However, total expenses dropped sharply to Rs 1,998.49 crore from Rs 2,615.15 crore, contributing to the improved profitability.

As of 1:49 pm on Friday, May 23, 2025, the shares of Reliance Power Ltd., rose to 15.66 per cent to Rs 51.56.

Published By : Nitin Waghela

Published On: 23 May 2025 at 14:05 IST