Published 21:43 IST, January 1st 2024

The Indian economy's resilience, coupled with proactive policy measures, positions it as one of the fastest-growing economies globally.

Advertisement

Despite facing challenges such as geopolitical tensions, inflation concerns and global issues like the Russia-Ukraine conflict, the market rebounded in the second half of 2023. Brokerage firm Religare Broking predicts a robust performance for Indian markets in 2024, following a rollercoaster ride in 2023. The Sensex and Nifty gained 19 and 20 per cent respectively in 2023 hitting record highs.

Nifty50 hit a record high of 21,801.45 in the final trading session of 2023 while Sensex hit a record high of 72,484.34.

Advertisement

Entering 2024 with an optimistic outlook, the brokerage firm anticipates double-digit growth, citing factors like moderating inflation, steady interest rates, and consistent FII and DII inflows.

The Indian economy's resilience, coupled with proactive policy measures, positions it as one of the fastest-growing economies globally. However, the brokerage advises investors to navigate potential market volatility by focussing on specific sectors and stocks in the mid to large-cap space.

Advertisement

From a technical perspective, the Indian markets performed well in 2023, with Nifty gaining 20 per cent. The broader indices, particularly midcap and smallcap, outperformed, rising approximately 44 per cent and 53 per cent, respectively.

The current technical outlook suggests further potential for Nifty to reach 22,650 and 24,100 in the medium to long term, with support levels at 20,250 and 19,000 in case of a decline.

Advertisement

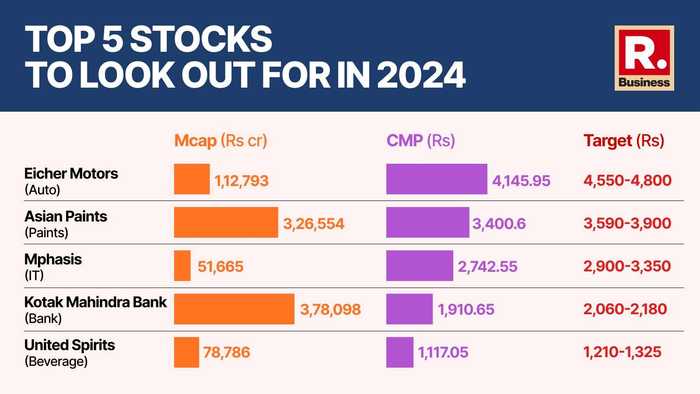

Here are the five top stocks for investment based on their fundamental strength, relative strengths:

Kotak Mahindra Bank

The bank is expected to see a steady rise after retesting the lower band of its consolidation range, supported by a positive chart structure and buoyancy in the banking sector. The brokerage has set the bank’s target price in the range of Rs 2,060-2,180.

Advertisement

Asian Paints

Asian Paints, a consistent performer in the paint industry, is poised to break out from a two-year consolidation range, driven by government spending on infrastructure, robust festive demand, and its strong market position. Its target price ranges from Rs 3,590 to Rs 3,900.

Advertisement

Eicher Motors

Eicher Motors, a leading player in premium motorcycles, is showing positive traction after a corrective phase, presenting a fresh buying opportunity. The company is expected to benefit from the industry shift towards 125+cc motorcycles and its focus on electric vehicles. Religare has a target price of Rs 4,550-4,800.

United Spirits

United Spirits has registered a decisive breakout and is gradually moving higher, finding support at its short-term moving average. The company, backed by Diageo PLC, is well-positioned in the alcohol industry, with a focus on premium products and a debt-free status. The target price for the stock is between Rs 1,210-1,325.

Mphasis

Mphasis has recently ended a two-year corrective phase and is forming a fresh buying pivot. With a breakout from a bullish Cup and Handle pattern, coupled with positive trends in the IT sector, Mphasis is showing buying interest at elevated levels. The brokerage has set a target price of Rs 2,900-3,350.

12:36 IST, January 1st 2024