Published 13:17 IST, February 24th 2024

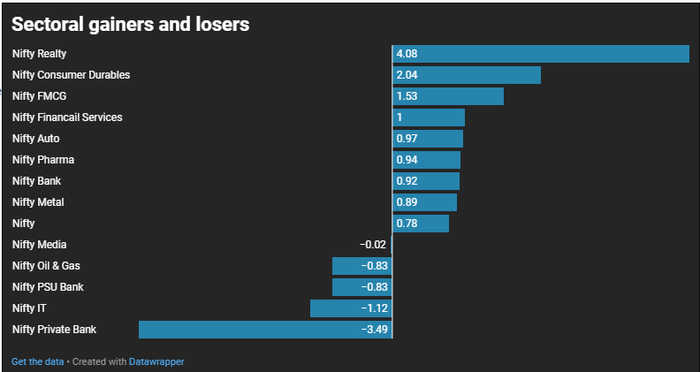

Sector-wise, realty, FMCG, and metal sectors emerged as the top performers, contributing to the overall positive sentiment.

Advertisement

In a week marked by volatility, the Sensex and Nifty managed to eke out gains of nearly a percent, bringing relief to investors amid global uncertainty. The benchmark indices, Nifty and Sensex, closed at 22,212.70 and 73,142.80 respectively, after navigating through mixed global cues and sporadic profit-taking in select heavyweight stocks.

Sector-wise, realty, FMCG, and metal sectors emerged as the top performers, contributing to the overall positive sentiment. However, the broader indices failed to mirror the enthusiasm and concluded the week on a relatively flat note.

Advertisement

Analysts foresee continued volatility ahead, primarily attributed to the scheduled expiry of February month derivatives contracts. Additionally, market participants are advised to closely monitor the performance of global indices, particularly focusing on cues from the US markets.

Amid the market fluctuations, the Dow Jones Industrial Average (DJIA) in the US crossed a significant milestone, surpassing the 39,000 mark. The index's resilient upward trajectory, backed by a strong base around 38,400, is anticipated to bolster positive sentiment in Indian markets, said Ajit Mishra of Religare Brooking.

Advertisement

“Technical analysis indicates that the Nifty has maintained support above the short-term moving average of 20 DEMA (20-Day Exponential Moving Average) during recent downturns. Despite mixed performances from index heavyweights, experts anticipate a steady uptrend towards the 22,500-22,800 zone, with select index majors likely to drive momentum,” Mishra added.

In the event of profit-taking, the 21,550-21,900 zone is expected to provide support, offering investors an opportunity to adopt a "buy on dips" strategy with a focus on prudent stock selection.

Advertisement

As market participants brace for ongoing volatility, strategic approaches coupled with vigilant monitoring of global market movements are deemed essential for navigating through uncertain times and capitalising on potential opportunities, Mishra said.

13:17 IST, February 24th 2024