Published 16:05 IST, January 10th 2024

Despite facing short-term challenges in consumer healthcare, Zydus Life remains committed to strengthening its brand franchise by leveraging various trade chann

Advertisement

Zydus Life in focus: Zydus Life is strategically working to enhance growth prospects in key markets, focussing on multiple fronts to bolster its position.

The company is not only aiming to expand its domestic formulation (DF) business but is also making substantial investments in developing a specialised portfolio in new chemical entities (NCE), biosimilars, and vaccines, according to the brokerage firm Motilal Oswal.

Advertisement

Despite facing short-term challenges in consumer healthcare, Zydus Life remains committed to strengthening its brand franchise by leveraging various trade channels. Noteworthy acquisitions, such as Liqmeds, and approvals for unique products like Sitagliptin and transdermals, contribute to an intriguing product pipeline, and a robust growth in the US market.

Furthermore, the Ahmedabad-based company is capitalising on its niche product portfolio to extend its presence in emerging markets, contributing to overall growth, the brokerage firm noted. The company's fiscal year 2025 earnings forecast has been raised by 5 per cent to account for these niche launches.

Advertisement

While the pharmaceutical major is expected to conclude the year with a robust year-over-year earnings growth of 45.4 per cent, a more modest 3.5 per cent growth is anticipated in fiscal year 2025, Motilal Oswal said in a note.

Factors contributing to this include increased competition in g-Asacol and a gradual improvement in the uptake of generic g-Revlimid. Motilal Oswal analysts value Zydus Life at 20 times 12-month forward earnings, establishing a target price of Rs 710, and maintain a neutral stance on the stock, citing limited upside potential at its current levels.

Advertisement

In terms of business segments, Zydus Life is actively working to strengthen its DF business by focussing on marketing activities for core brands and ensuring widespread product availability. The introduction of innovative products, particularly in progressive therapies like Cardiac, Respiratory, Gynecology, and Oncology, is expected to contribute notably to DF revenue growth.

Image Credits: Pexels

Advertisement

Consumer healthcare, while facing challenges, is undergoing a brand-building initiative, utilising digital media, e-commerce channel activations, and consumer-sampling initiatives to foster brand growth. Sales in this segment are projected to achieve a 10 per cent compound annual growth rate (CAGR) over fiscal years 2024 to 2026, the brokerage firm said.

In the US market, Zydus Life has experienced a strong revival, driven by niche launches and a robust product pipeline, including transdermals, REMS products, and limited competition offerings. The company's strategic acquisitions and the gradual ramp-up of key products are expected to contribute to an 8 per cent sales CAGR over fiscal years 2024 to 2026.

Advertisement

Zydus Life's success extends to emerging markets and the European formulation business, where superior execution and focus on select regions have resulted in notable sales growth. Leveraging its biosimilar and vaccine portfolio in these markets, the company is expected to achieve a 19 per cent CAGR over fiscal years 2024 to 2026.

Overall, Zydus Life's efforts to improve growth prospects across diverse markets underscore its commitment to strategic expansion and market leadership.

Financial performance

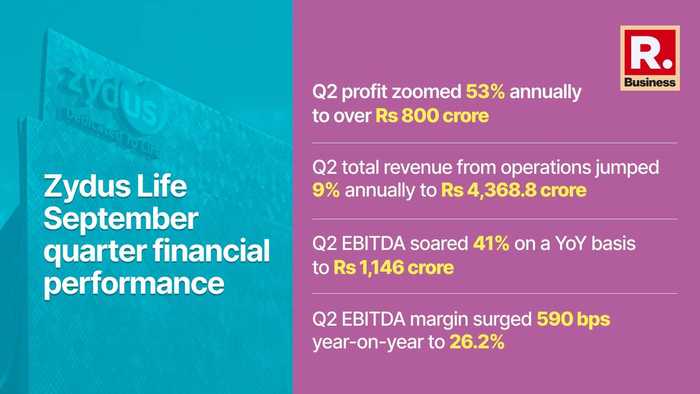

Zydus Life’s profit zoomed 53 per cent year-on-year (YoY) to over Rs 800 crore for the second quarter ended September 2023 (Q2FY24), from Rs 522.5 crore in the same quarter a year ago (Q2FY23).

The pharmaceutical company's total revenue from operations jumped 9 per cent on a year-on-year basis to Rs 4,368.8 crore, from Rs 4,005.5 crore previous year.

The rise in revenue came on the back of US, Emerging Markets and Europe formulations and API businesses.

Zydus Life's earnings before interest, taxes, depreciation and amortisation (EBITDA) zoomed 41 per cent on a YoY basis to Rs 1,146 crore, from Rs 815 in the year-ago period.

Its EBITDA margin surged 590 basis points year-on-year to 26.2 per cent.

Notably, Zydus Life’s stock zoomed nearly 56 per cent in 2023. The stock’s 52-week high is Rs 720.70 while its 52-week low is Rs 421.30.

As of 9:32 am, Zydus Life stocks were trading marginally higher at Rs 713.50 per share.

09:41 IST, January 10th 2024