Published 19:51 IST, March 7th 2024

When it comes to the DMA, Microsoft has successfully avoided getting hit as badly as it could have.

Advertisement

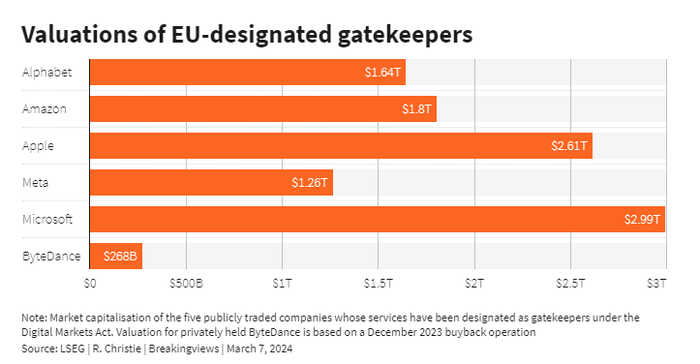

Cloud climbers. Brussels’s Big Tech D-Day is here. On Thursday the European Union starts formally requiring so-called “gatekeeper” platforms run by the biggest technology giants to spur competition by complying with its Digital Markets Act (DMA). Yet Microsoft is a case study of how U.S. firms can still do business in Europe despite the regulatory surge.

Europe may not be a global leader in hosting megafirm headquarters, but it’s determined to take pole position on regulating the world’s digital behemoths. The flagship DMA has assigned gatekeeper status to Alphabet, Amazon.com, Apple, ByteDance, Meta Platforms, and Microsoft. They will be expected to open up their app stores, messaging networks and search engines to fair competition, or risk fines amounting to 10% of their global turnover. Meanwhile the EU’s new Artificial Intelligence Act, enacted in February, aims to curb risks across the industry, taking particular aim at industry-leading U.S. group OpenAI while leaving room for EU-based challengers to scale up.

Advertisement

When it comes to the DMA, Microsoft has successfully avoided getting hit as badly as it could have. Only the $3 trillion group’s Windows operating system and LinkedIn social network were caught under new “gatekeeper” regulations. Its Bing search engine, Edge browser and Microsoft Ads marketing platform were all deemed to lie below the cutoff.

The Artificial Intelligence Act presents a further challenge for U.S. big tech. The EU is focused on safety rather than competition, but has also bowed to lobbying efforts from France and Germany. Paris and Berlin’s respective Mistral AI and Aleph Alpha startups have so far been allowed more leeway – only $90 billion OpenAI is deemed to have a “general purpose” AI model large enough to trigger the toughest rules. Microsoft’s response has been to spend $15 million stake in Mistral, which was recently valued at 2 billion euros.

Advertisement

This is way less than the $10 billion Microsoft boss Satya Nadella pumped into OpenAI. But the sight of U.S. big tech muscling in proved controversial enough for Dutch lawmaker Kim van Sparrentak to tell Reuters that the EU had given in too easily. She had reason to protest – the deal allows Microsoft to route Mistral Large, the French company’s newest AI model, through its own cloud servers. Given that Mistral has been a standard-bearer for European hopes of growing a homegrown artificial intelligence champion, the risk is it shunts a nascent market towards control by the established players.

But Mistral needs U.S. expertise if it wants to play in the big leagues. The French startup is barely a year old, set up by former Meta and Google artificial intelligence researchers, and will have to grow to compete with rival technology at more established firms. Companies building new general-purpose AI need large amounts of cloud computing to train their models, and U.S. tech giants are the only ones with enough capacity. In addition to the deal with Microsoft’s Azure cloud computing platform, Mistral is also taking two of its models to Amazon.

Advertisement

Nadella may yet get Brussels pushback over its stake in OpenAI, which European regulators are already investigating. But ultimately U.S. big tech and European politicians have scope for common ground – the former wants access to the European market, and the latter need big tech cash and know-how for their tech sector to grow. So far Microsoft is a case study in how that dynamic can work.

Context News

Microsoft on Feb. 26 announced a multi-year deal to make Paris-based Mistral AI’s artificial intelligence model available on its Azure cloud computing system. As part of the arrangement, Microsoft will take a 15 million euro minority stake in the French startup. Mistral was last valued at 2 billion euros in a funding round in December led by investors such as Andreessen Horowitz and Lightspeed. Microsoft has a market capitalisation of about $3 trillion. European Parliament members have asked for an antitrust investigation into the deal, while raising concerns that France’s lobbying on behalf of EU companies like Mistral also aided the U.S. tech giant.

Advertisement

19:51 IST, March 7th 2024