Updated April 19th, 2024 at 20:17 IST

Netflix plots feel-good story in a horror festival

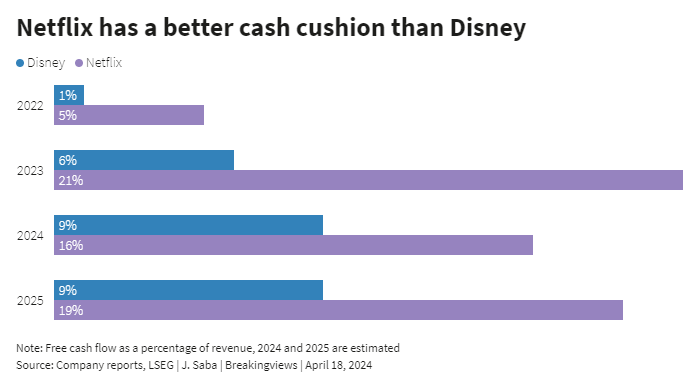

As others play catchup, Netflix has improved its cash generation. Every $100 of revenue this year is expected to turn into $16 of free cash flow.

- Business

- 3 min read

Advertisement

Game, set…. Netflix is laughing its way through the streaming-industry horror show. The company behind “One Day” is signing up more customers as laggard rivals prioritize profit ahead of growth. An expanding cash pile also provides an opportunity to widen the lead.

Cracking down on password-sharing helped Netflix add 9 million net new subscribers in the latest quarter. On top of its 270 million paying viewers worldwide, another 100 million had been freeloading off other people’s accounts. About 20% of them have been converted, and another 60% could be over the next three years, Oppenheimer analysts estimate. The success already has spawned copycats: Walt Disney is planning to stop login credentials from being used by multiple watchers. In another sign of its clout, Netflix said on Thursday it would stop reporting quarterly membership numbers to spotlight financial metrics like operating margin instead.

Advertisement

As others play catchup, Netflix has improved its cash generation. Every $100 of revenue this year is expected to turn into $16 of free cash flow, according to estimates gathered by LSEG. It’s $9 at Disney and $13 for HBO owner Warner Bros Discovery.

Such advantages have created heady expectations. Netflix’s share price is up some 80% this year, quadruple the S&P 500 Index. Since April 2023, forecasts of the company’s 2025 earnings per share have increased by about a fifth while its valuation multiple roughly tripled over the same time frame, according to MoffettNathanson analysts.

Advertisement

These trends indicate some anticipation that co-CEOs Ted Sarandos and Greg Peters will use some of the $7 billion of cash to grow further as competitors struggle off the back foot. Many of them are slashing production budgets and licensing movies to reach profitability.

Video games are a promising area for Netflix. It has rolled out dozens of them already, including one based on its “Love is Blind” series. These fledgling efforts make it easy to imagine bolder deals and initiatives in the works. Netflix mentioned selective M&A on Thursday.

Advertisement

As the company pushes a lower-price service with commercials, live events also make more sense. Earlier this year, it signed a $5 billion deal to air WWE professional wrestling for a decade and is touting a boxing match this summer with 57-year-old Mike Tyson. Although Netflix has been vocal about staying out of the sports-rights fray, it wouldn’t be a stretch to see it jump in now. After all, it changed its thinking on ads, too. And with the edge Sarandos and Peters have created, they will keep playing to win.

Context News

Netflix said on April 18 it added 9 million net new subscribers in the quarter ending March 31, better than the 5 million analysts were expecting, according to estimates on LSEG. Its worldwide customer count reached 270 million. The streaming-video company reported first-quarter revenue of $9.4 billion, a 15% rise from the same quarter a year earlier. Free cash flow during the period was $2.1 billion.

Advertisement

Published April 19th, 2024 at 20:17 IST