Updated March 30th, 2024 at 12:21 IST

Odd Washington deal creates anti-M&A synergy

Movements against corporate concentration and the ultra-rich are getting bigger.

- Business

- 2 min read

Advertisement

Share alike. One small deal in Washington undermines larger ones designed on Wall Street. Two U.S. senators at opposite ends of the political spectrum have joined forces to target favorable tax treatment for companies that combine by swapping stock. Movements against corporate concentration and the ultra-rich are getting bigger.

Sheldon Whitehouse, a progressive Democrat, and JD Vance, a populist Republican, introduced a bill last week that would force shareholders receiving a buyer’s stock as currency in a merger to pay capital-gains tax right away instead of deferring it until they realize cash gains by selling the equity. The legislators say the tax code subsidizes such “tax-free reorganizations,” like Capital One Financial’s $35 billion acquisition of Discover Financial Services, because cash deals by comparison trigger an immediate tax on any appreciation in value captured by the acquirer and the target’s investors.

Advertisement

It’s a half-baked argument, partly because other deal costs are subsidized, too. For example, any company that borrows money to fund a cash bid benefits from the tax-deductibility of interest expenses. A more compelling case is that wealthy shareholders often hang onto stock for so long, sometimes bequeathing it to heirs, that they wind up avoiding capital gains tax altogether.

Further, the legislation hardly seems aimed at stuffing Uncle Sam’s pockets. There have been about $3 trillion of purely share-based U.S. deals over the past decade. About 70% of shareholders, including overseas and pension funds, don’t pay U.S. capital gains taxes, leaving stakes worth $900 billion. Assume the sum represents a 25% uplift on the total cost basis, tax it at 20% and there would be about $4.5 billion in levies a year. The crudely calculated figure is more than the $1.4 billion available annually from eliminating the carried-interest tax loophole, according to 2018 Congressional Budget Office research, but also would hardly register in a $6 trillion federal budget.

Advertisement

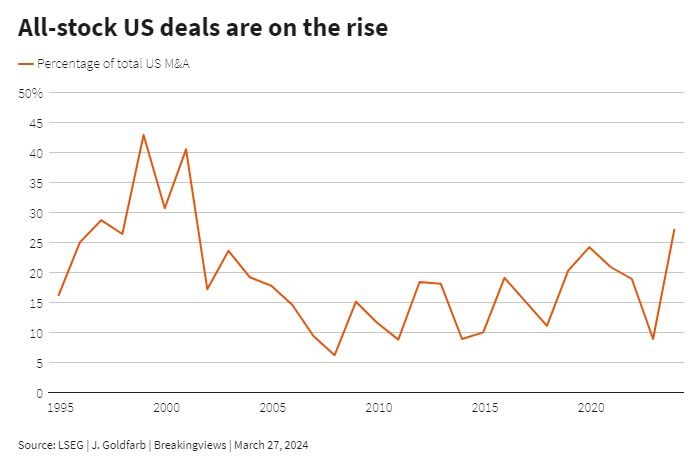

Instead, Whitehouse and Vance are mainly building on the consolidation backlash led by U.S. President Joe Biden’s administration. All-stock mergers are on the rise, accounting for about 27% of M&A activity last year, the highest proportion since 2000, according to LSEG data. Even as some Republicans have railed against trustbusting efforts, monopolistic behavior is increasingly becoming a bipartisan issue. The latest measure against mega-mergers has little chance of becoming law anytime soon, but it contributes valuable synergies.

Advertisement

Published March 30th, 2024 at 12:12 IST