Published 12:41 IST, January 31st 2024

Taxpayers are pressing the government to focus on enhancing the appeal of the new tax system.

Advertisement

Tax revamp demands: Taxpayers are urging the government to concentrate on making the new tax regime more attractive, simplifying processes, ensuring effective tax collection, and resolving legal disputes efficiently as Union Finance Minister Nirmala Sitharaman gears up to present an interim budget on February 1, 2024, ahead of the Lok Sabha elections in May.

Advertisement

Taxpayer demands: New regime wishlist?

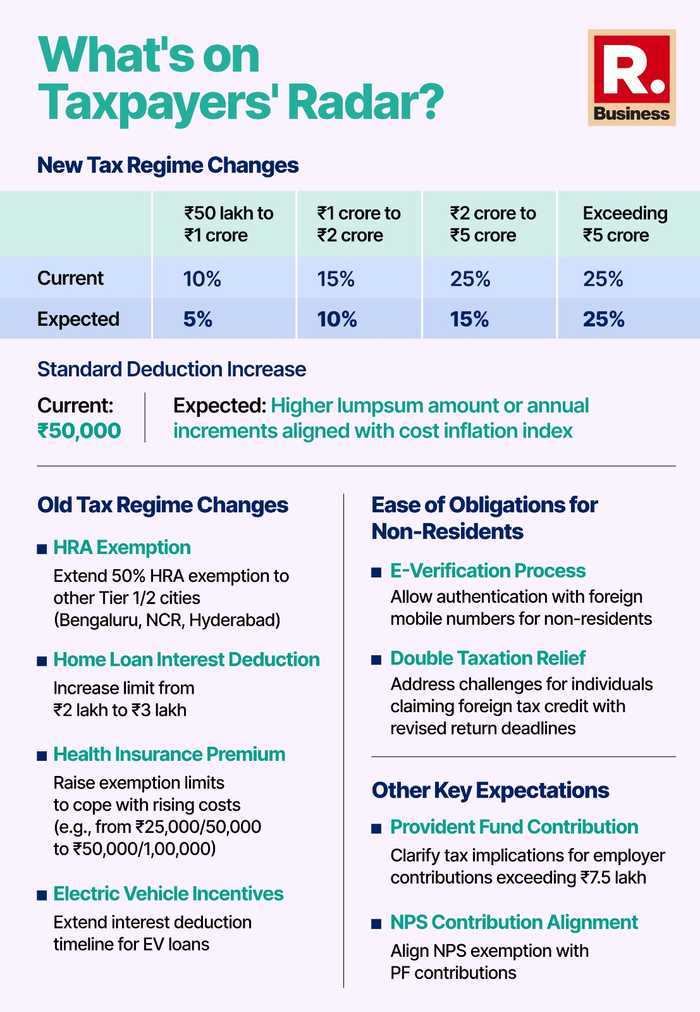

Individual taxpayers have specific expectations for Budget 2024. Firstly, changes in the new tax regime are anticipated, with a focus on surcharge rates. There is an expectation of a reduction in surcharge rates for various income brackets, providing relief to those earning between Rs 50 lakh to over 5 crore. Additionally, there is a call for an adjustment to the standard deduction under the new regime, either increasing the current Rs 50,000 or aligning it annually with the cost inflation index.

Taxpayer demands: Old regime wishlist?

In terms of changes in the old tax regime, taxpayers in tier I and tier II cities are expecting an increase in the House Rent Allowance (HRA) exemption to 50 per cent, similar to Delhi, Mumbai, Chennai, and Kolkata. Home loan borrowers anticipate an increase in the limit for deducting home loan interest from the existing Rs 2 lakh to Rs 3,00,000. Moreover, there are expectations for an increase in exemption limits for mediclaim insurance payments due to rising health insurance costs post-COVID-19. An extension of the timeline for maximum deductions on loans sanctioned for purchasing electric vehicles is also anticipated.

Advertisement

Effortless non-resident taxation

In terms of ease of obligations for non-residents, there is a call for an authentication process using foreign mobile numbers for e-verification of tax returns, reducing paperwork and administrative efforts. Additionally, individuals facing challenges with claiming relief from double taxation due to mismatched deadlines for tax returns in different jurisdictions are hopeful for an extended deadline.

Other key expectations include clarity on the taxation of employer annual contributions exceeding Rs 7.5 lakh to Provident Fund, Superannuation, and National Pension System. There is also a demand to align the exemption limit for employer contribution to the National Pension System (NPS) with that of the Provident Fund (PF) to motivate individuals to invest more in NPS for better post-retirement financial security.

10:15 IST, January 22nd 2024