Published 12:54 IST, January 31st 2024

Fintech experts push for a dedicated fund (IFCF) to empower MSMEs, expand in Tier-4 cities, and extend credit to women and thin filers.

Advertisement

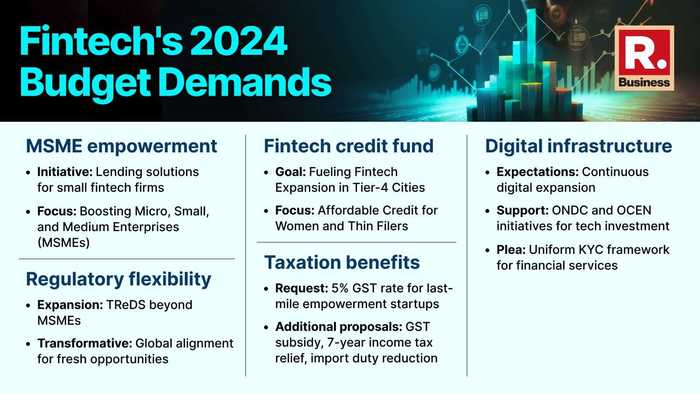

India's fintech hopes: Anticipations are high in India's fintech industry as it looks forward to developments in the upcoming Interim Budget scheduled for presentation on February 1, 2024. The fintech industry in India is eagerly awaiting the Interim Budget with expectations centred around the creation of a Fintech Credit Fund, taxation benefits, expansion of digital infrastructure, and regulatory flexibility to further foster its growth and contribute to financial inclusion.

"In the Interim Budget 2024, a significant focus is anticipated on fortifying the fintech sector, a key driver of India's digital economy. The Indian fintech market, projected to reach $150-160 billion by 2025, is at the forefront of this strategic focus. The government's focus on developing a robust digital infrastructure is crucial, encompassing enhanced internet connectivity, advanced cybersecurity, and the integration of technologies like blockchain and AI, to ensure a secure and efficient digital landscape," said Karan Gupta, Co-Founder and Director, KAPSO.

Advertisement

Financing fintech futures

Fintech experts are particularly keen on initiatives that would empower micro, small, and medium enterprises (MSMEs) by facilitating lending solutions.

They emphasise the importance of supporting small and medium-sized fintech firms and propose the establishment of a dedicated India Fintech Credit Fund (IFCF). This fund aims to provide affordable financial assistance to fintech companies, promoting their expansion, especially in Tier-4 cities, and extending credit to women and thin filers.

Advertisement

"Indian fintech companies see great potential in expanding into rural and semi-urban consumers and this seek policies that enhance financial inclusion. While the budget is only a Vote on Account and a detailed version would appear only post formation of a new government, a key desire is for the government to continue its support for digital infrastructure and technology adoption. We expect to see more initiatives that spur rural financial services adoption and expansion and allow for new fintech-led business models to operate," said Neha Juneja, CEO, IndiaP2P.

Tax reforms, digital drive

Taxation is also a focal point for the fintech industry's wishlist. Experts are calling for tax benefits on total expenditure for fintech firms involved in the financial empowerment mission. A specific proposal includes a 5 per cent GST rate for startups working towards last-mile empowerment, aiming to enhance the accessibility of financial services and government benefits. Additionally, requests have been made for a GST subsidy, waiver of GST on financial services from Business Correspondent (BC) outlets, a seven-year income tax relief, and reduced import duty on essential financial services devices.

Advertisement

The digital infrastructure is considered a crucial element for boosting the entrepreneurial spirit and economic growth. Expectations include continued government efforts to expand digital infrastructure, supporting deep penetration of financial services. Calls have been made to back initiatives like the Open Network for Digital Commerce (ONDC) and Open Credit Enablement Network (OCEN) to incentivise investment in technology and research and development (R&D). There's also a plea for the implementation of a uniform Know Your Customer (KYC) framework across all financial services to enhance efficiency and boost financial inclusion.

Advertisement

Flexing fintech rules

Regulatory flexibility is another key area of interest for the fintech industry. Experts anticipate the expansion of the Trade Receivables Discounting System (TReDS), not limited to MSMEs but extending to non-MSME entities. This move is seen as transformative, unlocking fresh opportunities and aligning with global practices. Tax breaks are suggested to create a favourable environment for fintech innovation, with a focus on incentivising fintech in under-serviced areas. The industry is eager to see measures that recognise fintech's role in empowering MSMEs and SMEs, particularly in Tier 2, 3, and 4 cities.

In terms of the outlook for fintech in 2024, the observed trend is the evolution of business models which index towards early profits. Startups are likely to continue facing difficulty in capital raises prohibiting growth models that rely on high customer acquisition costs in the medium to long term. We may also see consolidation in various sub-sectors and larger startups adding features that contribute to the bottom line. Businesses will also evolve to incorporate the latest in AI and blockchain developments.

Advertisement

17:07 IST, January 15th 2024