Published 12:33 IST, January 20th 2024

In December 2023, health segment premiums hit Rs 9,079.7 crore, boasting a 23.0% YoY surge, while YTD FY24 figures revealed a 21.4% increase.

Advertisement

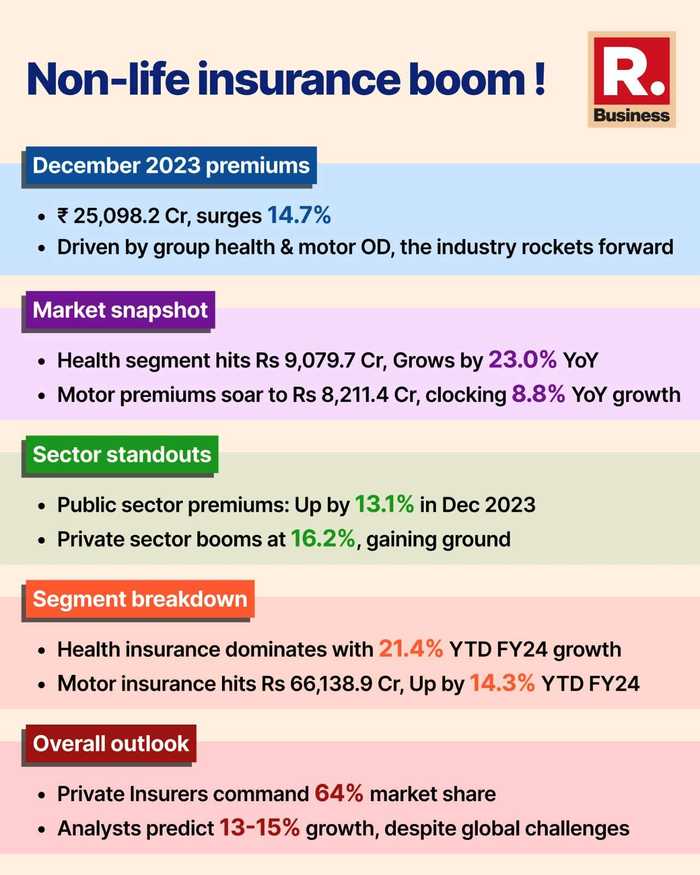

Premiums on fire: The non-life insurance sector in the country has reported a substantial surge in premiums, reaching Rs 25,098.2 crore in December 2023. This marks growth of 14.7 per cent, outpacing the previous month's 8.8 per cent and aligning with the 14.5 per cent growth observed in December 2022, according to a report by CareEdge. The driving force behind this uptick in growth has been the performance of the Group Health and Motor OD segments.

The movement in segment premiums within the non-life insurance industry in India showcases growth across various sectors. In December 2023, the Health segment reported premium of Rs 9,079.7 crore, marking a year-on-year (YoY) growth of 23.0 per cent. This growth trend is also reflected in the Year-to-Date Fiscal Year (YTD FY24) figures, where the Health segment has seen an increase of 21.4 per cent, reaching Rs 79,559.4 crore.

Advertisement

Health wealth: Group & retail premiums skyrocket

Within the health segment, the Group category experienced a notable YoY growth of 24.0 per cent, with premiums reaching Rs 4,859.6 crore in December 2023. The YTD FY24 figures for Group Health premiums stood at Rs 42,100.7 crore, indicating a growth rate of 20.8 per cent. Similarly, the Retail sub-segment within Health reported a YoY growth of 18.9 per cent, with premiums of Rs 3,775.1 crore in December 2023. The YTD FY24 figures for Retail Health premiums reached Rs 28,714.6 crore, reflecting a substantial growth rate of 18.7 per cent.

The "Others" category in Health, however, witnessed a decline of 35.0 per cent in premiums in December 2023, but the YTD FY24 figures tell a different story. Despite the monthly drop, the YTD FY24 premiums for this category increased by 34.4 per cent, reaching Rs 8,744.1 crore.

Advertisement

Motor magic: Premiums in overdrive

Moving to the motor segment, the overall premiums increased by 8.8 per cent YoY in December 2023, amounting to Rs 8,211.4 crore. The YTD FY24 figures for Motor premiums reached Rs 66,138.9 crore, with a growth rate of 14.3 per cent. The Own Damage (OD) sub-segment in Motor reported a growth of 13.4 per cent in December 2023, reaching Rs 3,382.3 crore. The Third-Party (TP) sub-segment, however, experienced a slower growth rate of 5.8 per cent in December 2023, with premiums totaling Rs 4,829.0 crore. The YTD FY24 figures for Motor OD and TP premiums indicate growth rates of 18.5 per cent and 11.4 per cent, respectively.

Other segments like fire and crop Insurance also demonstrated positive growth, with Fire premiums increasing by 11.5 per cent in December 2023, and Crop Insurance premiums growing by 9.6 per cent. However, the Crop Insurance segment experienced a marginal decline of 0.3 per cent in YTD FY24.

Advertisement

The aggregated Grand Total premium for December 2023 stood at Rs 25,098.3 crore, reflecting an overall YoY growth of 14.7 per cent. The YTD FY24 Grand Total reached Rs 2,13,486.1 crore, indicating a steady growth rate of 14.0 per cent.

Despite marginal declines in growth rates in some segments, the industry has maintained its upward trajectory, with Year-to-Date Fiscal Year 2024 (YTDFY24) continuing to double-digit growth.

Advertisement

Public sector dominance persists

In terms of sector-wise performance, public sector premiums have remained a significant component, contributing to approximately one-third of the aggregate premium. Public sector general insurers recorded a growth of 13.1 per cent in December 2023, in stark contrast to the modest 0.7 per cent increase in the same month of the previous year. Meanwhile, private sector general insurers reported a growth of 16.2 per cent in December 2023, slightly down from the 24.1 per cent growth recorded in December 2022. On the other hand, specialised insurers experienced a decline of 8.7 per cent in December 2023, continuing a trend observed in previous months.

Market dynamics reveal that private non-life insurance companies have expanded their market share to 64 per cent for YTDFY24, up from 62 per cent in FY23 and 59 per cent in FY22.

Advertisement

Projected surge in non-life insurance

Analysts project a continued growth rate of 13 per cent to 15 per cent in the medium term for the Indian non-life insurance market. The health and motor insurance segments are anticipated to surpass thresholds in FY24, driven by rising disposable incomes and growth across other segments. Despite potential challenges stemming from an uncertain international geopolitical environment and elevated inflation, the overall outlook for the non-life insurance sector remains stable in the medium term. The sector's growth will be further supported by a favourable regulatory environment, stabilised loss ratios, and strategic expense management.

09:06 IST, January 16th 2024