Published 14:40 IST, December 26th 2023

As we near the end of 2023 and anticipate 2024, a series of financial changes are set to come into effect on January 1.

Advertisement

Financial shake-up: As we approach the close of 2023 and look forward to 2024, a set of financial changes is poised to take effect from January 1. The upcoming alterations include the introduction of nominee options for Demat account holders, the deactivation of inactive UPI IDs, the necessity for a renewed agreement concerning bank lockers, and the phasing out of paper-based KYC for SIM cards.

Key tasks to complete by December 31

Empowering Demat account holders:

The deadline extension by the Securities and Exchange Board of India (SEBI) provides existing Demat account holders three additional months until December 31, 2023, to nominate another individual. Physical security holders are also granted until this date to furnish PAN, nomination, contact details, bank account details, and specimen signatures corresponding to their folio numbers.

Advertisement

Inactivity measures for UPI IDs:

In a circular dated November 7, the National Payments Corporation of India (NPCI) mandates that payment apps and banks deactivate UPI IDs and numbers dormant for over one year. All banks and third-party apps must comply with this directive until December 31.

Renegotiating bank locker agreements:

Advertisement

As per the Reserve Bank of India (RBI), the revised rules for safe deposit lockers necessitate customers to engage in a fresh agreement with their banks. The deadline for this renegotiation is December 31, 2023. The ability to use the locker is contingent upon timely rent payments.

Timely action on belated ITR filing:

-1703502715377.webp)

With the deadline approaching on December 31, 2023, individuals are urged to file Income Tax Returns for the fiscal year 2022-23. Section 234F of the Income Tax Act imposes a late filing fee for those missing the due date. The penalty is Rs 5,000, but individuals with a total income below Rs 5 lakh face a reduced penalty of Rs 1,000.

Advertisement

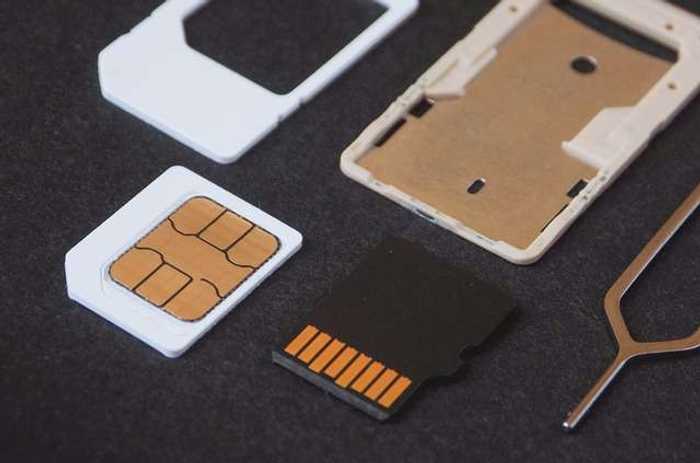

A digital shift for SIM card KYC:

Commencing January 1, 2024, the Department of Telecommunications (DoT) announces the cessation of the paper-based know-your-customer (KYC) process for obtaining new SIM cards. The decision stems from amendments to the existing KYC framework, emphasising a digital transition.

17:00 IST, December 25th 2023