Updated March 10th, 2024 at 15:02 IST

Are homebuyers turning away from ready homes for new launches?

The ratio of ready homes to new launches shifted from 46:18 in H1 2020 to 23:24 in H2 2023, signalling a growing interest in new projects.

Advertisement

Shift to New Builds: Homebuyers are increasingly favouring new project launches over ready-to-move-in homes, according to the latest data from the Anarock Homebuyer Sentiment Survey.

The report reveals a notable shift in the preferences of prospective homebuyers towards new launches over ready homes. Historically, the preference leaned towards ready properties due to concerns over project delays and uncertainty associated with smaller developers.

However, the tide has turned, with larger and reputed developers now leading the charge in new project launches. This change is attributed to the increased confidence amongst homebuyers in the timely delivery of projects by established developers.

Advertisement

Developer reliability matters

Analysis of the survey data indicates that in the second half of 2023, the ratio of ready homes to new launches stood at 23:24, marking a stark reversal from the ratio of 46:18 observed in the first half of 2020.

This shift underscores the growing interest in new launches, fuelled by the improved reputation of established developers for delivering quality projects on time.

Splurge or save: Housing hues

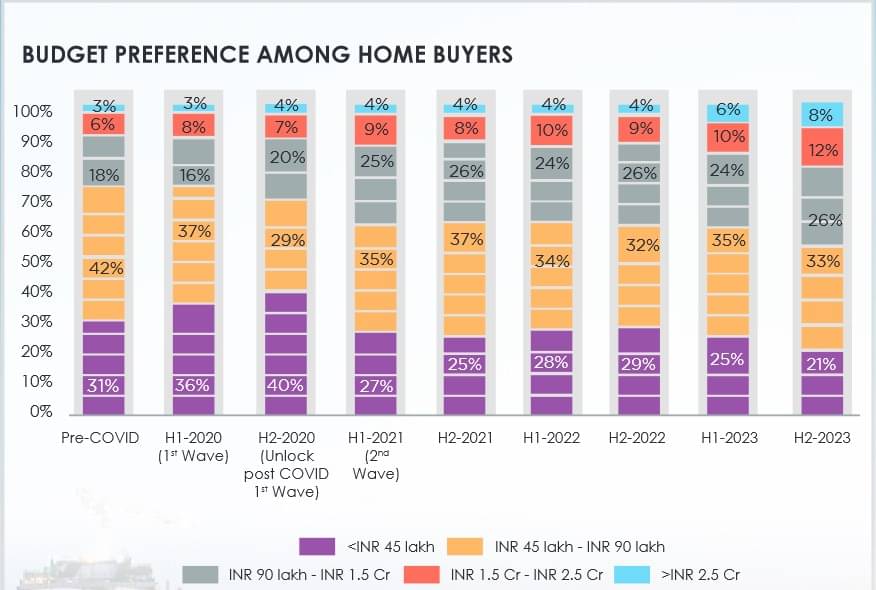

Moreover, the survey highlights a shift in budget preferences amongst homebuyers, with a growing inclination towards premium and luxury homes priced above Rs 1.5 crore. While the budget range of Rs 45 lakh to Rs 90 lakh remains popular amongst a significant portion of prospective buyers, there has been a notable increase in demand for homes in the higher price brackets.

The report indicates that 20 per cent of respondents now prefer homes priced above Rs 1.5 crore, reflecting a substantial rise from 12 per cent in the previous survey cycle.

On the contrary, the affordable housing segment is experiencing a decline in demand, with only 18 per cent of new launches falling within this budget category in 2023, compared to 26 per cent in 2021 and a significant drop from 40 per cent in 2019.

This trend is attributed to the wait-and-watch approach adopted by buyers in this segment, prompting developers to reduce new supply in this budget range.

Advertisement

Published March 10th, 2024 at 15:02 IST