Published 18:13 IST, April 24th 2024

The Anarock report shows a rise in high-value property sales, with 6,416 residential properties registered, marking a 12% YoY increase in value at Rs 4,039 cr.

Advertisement

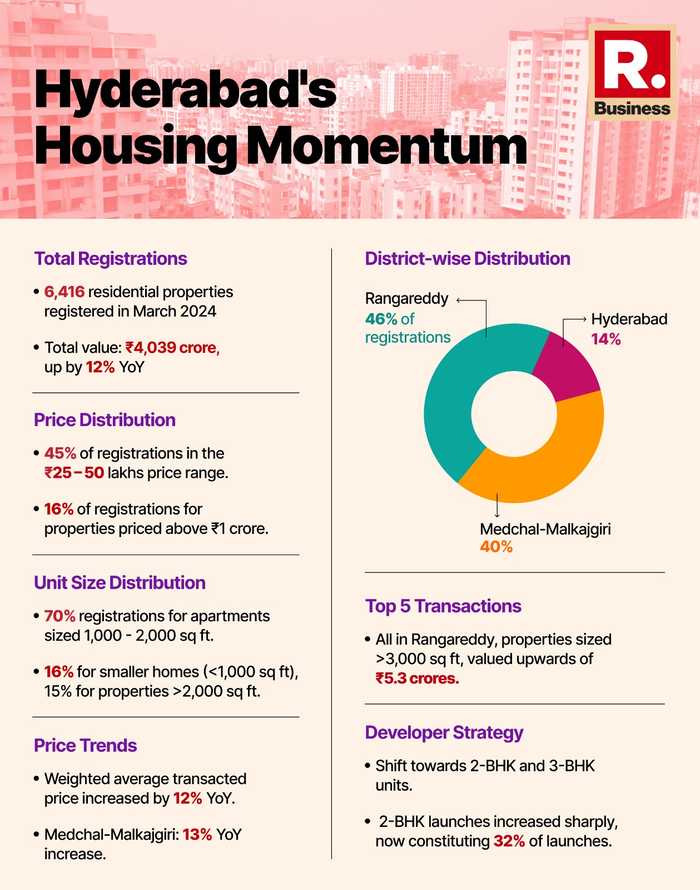

Hyderabad's housing high: The real estate market in Hyderabad experienced a notable surge in high-value home registrations during March 2024, according to the latest report from Knight Frank India. The report indicates a shift towards the sale of higher-value properties, with a total of 6,416 residential properties registered, representing a 12 per cent year-on-year (YoY) increase in registration value, totalling Rs 4,039 crore.

How is 2024 looking for Hyderabad?

In the realty market of Hyderabad, the year 2024 commenced with a steady volume of registrations, maintaining parity with the preceding year's figures. There was a notable surge in February, with a 25 per cent increase in registrations compared to the same period in 2023.

This momentum continued into March, although there was a slight downturn in the number of registrations, marking an 8 per cent decrease YoY. Despite this, the total value of registrations in March soared by 12 per cent compared to the previous year, reflecting a notable movement towards higher-value properties.

In terms of monetary value, January witnessed a substantial 24 per cent increase YoY, followed by an even more significant surge of 46 per cent in February. March, although experiencing a dip in volume, still recorded a 12 per cent growth in registration value compared to the corresponding period in 2023.

Advertisement

Price preferences and property sizes

Properties in the price range of Rs 25 – 50 lakh accounted for 45 per cent of all registrations, making it the most common price category.

However, the proportion of registrations for properties priced at Rs 1 crore and above rose to 16 per cent in March 2024, an increase from 10 per cent in March 2023.

Apartments in the range of 1,000 - 2,000 sq ft dominated registrations, constituting 70 per cent of all registrations.

Advertisement

Which districts are driving market growth?

In March 2024, the distribution of property registrations across districts in Hyderabad exhibited notable variations compared to the previous year.

Rangareddy emerged as the leading contributor, capturing 46 per cent of the market share, a significant increase from the 34 per cent recorded in March 2023.

Medchal-Malkajgiri maintained its share at 40 per cent of total registrations, demonstrating consistency YoY. However, Hyderabad district experienced a slight decline, comprising 14 per cent of registrations compared to 16 per cent in March 2023.

Notably, Sangareddy district saw a substantial decrease, accounting for only 1 per cent of registrations in March 2024, down from 10 per cent in the preceding year.

Top 5 real estate deals in Hyderabad

The top five real estate transactions in Hyderabad for the month were concentrated exclusively in Rangareddy district. All five transactions occurred in the Kondapur and Kokapet areas, indicating a preference for these locales amongst affluent buyers. Notably, each property involved exceeded 3,000 sq ft in area, reflecting a demand for spacious accommodation.

The highest-valued transaction, recorded in Kondapur, amounted to Rs 7.3 crore, followed closely by two additional transactions in the same area, each exceeding Rs 6.3 crore. Another notable transaction took place in Kokapet, with a property valued at Rs 5.86 crore.

Rounding off the top five was another transaction in Kondapur valued at Rs 5.32 crore.

Advertisement

Shift in apartment sizes

In the first quarter of 2024, the property market witnessed a shift in the types of apartment launches compared to the same period in 2023. While 1BHK and 2BHK apartments maintained a presence, there was a decline in the introduction of larger units.

Particularly notable was the complete absence of 2.5-BHK, 3.5-BHK, and 5-BHK apartments, indicating a clear downturn in the launch of mid-sized and larger units.

In contrast, the proportion of 2BHK apartments surged from 23 per cent to 32 per cent, reflecting a growing preference for moderately-sized units amongst buyers. The dominance of 3BHK apartments remained consistent, capturing the majority share of the market.

16:43 IST, April 22nd 2024