Updated May 3rd, 2024 at 17:19 IST

The warehousing sector sees investment highs, but is there a slowdown ahead?

Warehousing demand peaked at 4.8 million sq mt (51.3 million sq ft) in FY 2022, rebounding strongly from the lows witnessed during the pandemic period.

Advertisement

Warehousing market transformation: With e-commerce and online services becoming an integral part of everyone's life, the demand for online services has gone up like never before, fuelling the exponential growth of warehouses where things are stacked up for seamless delivery.

It was way back in 2022 when e-commerce and online services fuelled the growth of the warehousing sector post-pandemic. The pandemic not only made life centred around e-commerce and online services but also kept life riding on the back of digital services. But the phenomenal growth is fizzling out at least, which was driven by the boom in the e-commerce space.

Advertisement

Some analysts are of the view that the warehouse market is currently experiencing unprecedented demand, outpacing supply by 1.4 times in the first half of 2023.

Advertisement

However, in an exclusive interaction with Republic Business, Mudassir Zaidi, Executive Director – North, Knight Frank India shed light on the transformative journey of the warehousing market. He highlighted how significant changes, such as the introduction of GST, solar, DST, and IR, have reshaped warehousing operations.

He stressed the evolution of warehousing from traditional go-downs to sophisticated Grade A structures, attracting both domestic and global players. Zaidi underscored the influx of investment in the sector, leading to rapid expansion and acquisition of warehousing spaces.

Advertisement

"We've reached a stage where a lot of it has been acquired, is being built, is now being looked at for consumption," Zaidi said, indicating a shift towards utilisation rather than expansion.

However, he pointed out that the market is now experiencing a phase of consolidation and a slowdown in new inventory additions. This period is characterised by the absorption of existing supply, reorganisation, and consolidation efforts. "We are seeing some stagnation there above. We are seeing some consolidation and further expansions will happen," Zaidi elaborated, expressing confidence in the sector's resilience despite current challenges.

Advertisement

Resilience amidst uncertainty

The Indian warehousing sector has demonstrated resilience amidst the uncertainties of the global economic scenario, maintaining a steady trajectory since FY 2022. Warehousing demand peaked at 4.8 million sq mt (51.3 million sq ft) in FY 2022, rebounding strongly from the lows witnessed during the pandemic period. This heightened demand persisted into the subsequent year, despite a notable drop in demand from e-commerce entities.

Advertisement

With the e-commerce segment historically serving as a major catalyst for transaction volumes, the market witnessed a shift in dynamics as manufacturing sector companies stepped in to fill the void. This diversification in demand sources underscores the sector's adaptability to changing market forces.

However, the momentum witnessed in previous years saw a temporary slowdown in the first half of FY 2024 (April to September 2023). Transacted volumes amounted to 2.1 million sq mt (23 million sq ft), marking a 10 per cent decline compared to the corresponding period in FY 2023. Grade A spaces accounted for the majority of transactions, indicating a continued preference for quality infrastructure.

Advertisement

Trending industry shifts

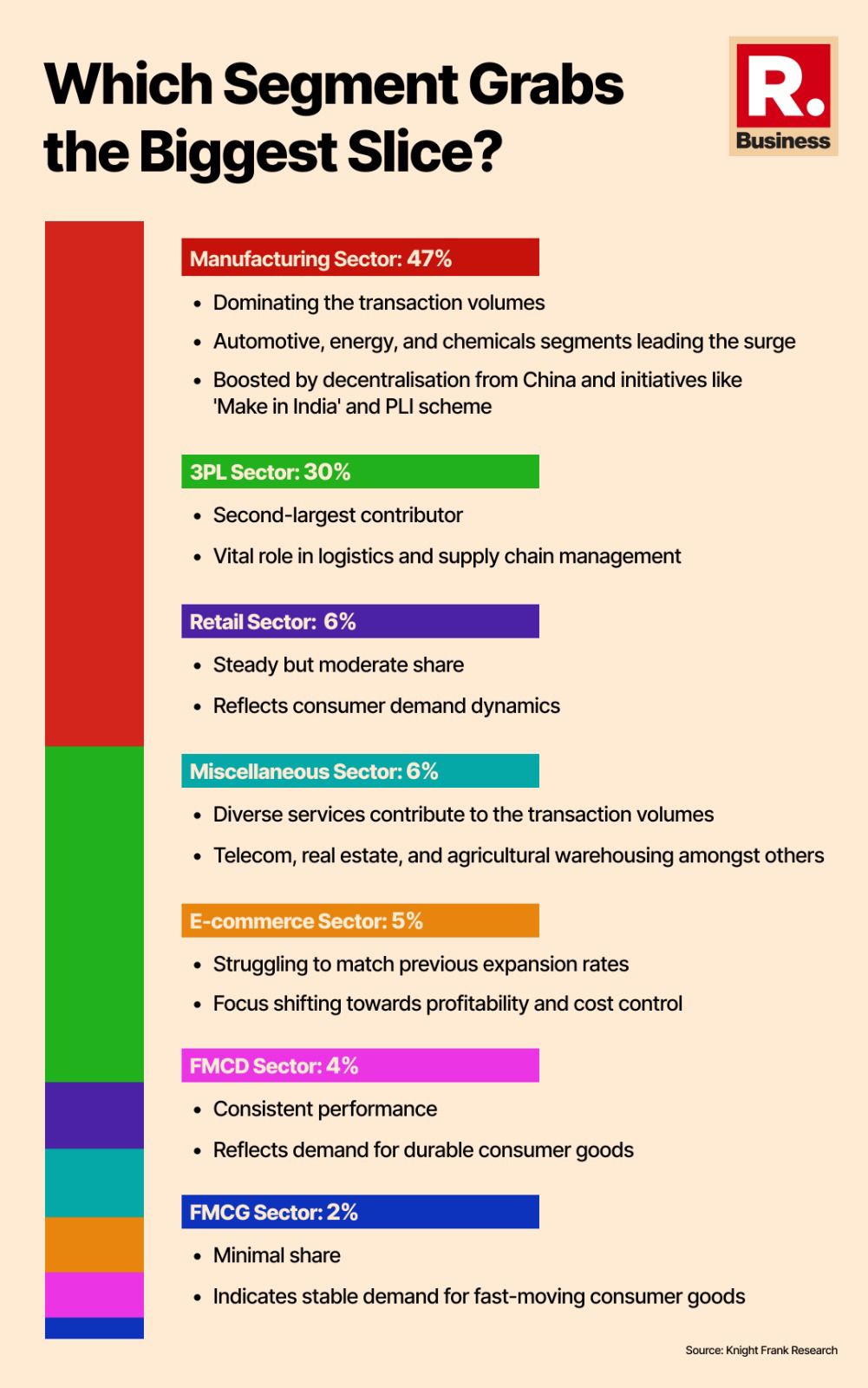

The manufacturing sector outpaced the 3PL (third-party logistics) sector in transaction volumes during H1 FY 2024. Companies operating in the automotive, energy, and chemical sectors constituted a substantial portion of the total transacted volume, signifying the growing importance of manufacturing investments in the country. Factors such as the decentralisation of manufacturing capacity from China and government initiatives like 'Make in India' and the Production Linked Incentive (PLI) scheme have contributed to this trend.

Meanwhile, 3PL sector companies continued to maintain their relevance, comprising 30 per cent of the transaction volume. Other sectors recorded minor contributions, highlighting the diversified nature of demand within the market.

Advertisement

Conversely, the e-commerce sector experienced a slowdown attributed to previous expansion efforts during the pandemic. Major players in the sector have shifted their focus towards profitability, resulting in subdued leasing activity. Large-format captive/owned spaces, serving as regional hubs for e-commerce giants, have also contributed to this trend, with their leasing activities not accounted for in market demand assessments.

Warehousing Post-GST

Zaidi stressed that pre-GST warehousing strategies were primarily driven by tax efficiency, with each state's tax laws playing a crucial role. However, with the advent of GST, which unified tax jurisdiction across India, logistical efficiency emerged as a paramount consideration in warehousing location decisions.

Despite these challenges, Zaidi expressed optimism about the prospects of the warehousing sector, anticipating further consolidation and expansion.

Advertisement

Buoyant outlook

Experts anticipate a buoyant outlook for India's warehousing sector, as the 3PL industry continues to play a pivotal role while manufacturing experiences significant growth. Despite cautious moves by the e-commerce sector, occupier demand remains resilient.

Advertisement

The global shift of manufacturing hubs towards India and other Asian nations, alongside India's focus on enhancing its manufacturing capabilities, promises sustained growth in the warehousing domain.

Although global economic and geopolitical factors may exert influence, India's robust fiscal position and resilient economy are expected to boost stability and growth potential in the warehousing market throughout fiscal year 2024, according to experts.

Advertisement

Published May 3rd, 2024 at 17:19 IST