Published 23:19 IST, February 26th 2024

Reddit plans to reserve a big chunk of shares in its initial public offering for its website’s users and moderato.

Advertisement

Meme dreams. The social media site that spawned “Wall Street Bets,” the online watering hole for the meme-stock craze, knows how to create hype. Reddit, which filed to go public last week, plans to reserve a big chunk of shares in its upcoming initial public offering for its website’s users and moderators. Rewarding community members through a so-called “affinity program” is risky, as similar deals have shown. But it will likely help Reddit founder Steve Huffman get what he wants.

The people who muse and debate on Reddit’s platform are paramount to its success. Their comments help attract paying advertisers to the site. Plus, Huffman has started selling the data they generate to artificial intelligence developers such as Google-parent Alphabet for training purposes, according to Reuters.

Advertisement

But there are problems with Reddit’s business model, like its dearth of consistent profit. Dollars designated to digital ads are increasingly competitive, and Huffman’s efforts to open other spigots have upset the site's volunteer moderators. And unless Reddit can ink lucrative, multi-year deals to license its content, its newer revenue stream could eat away at its core business.

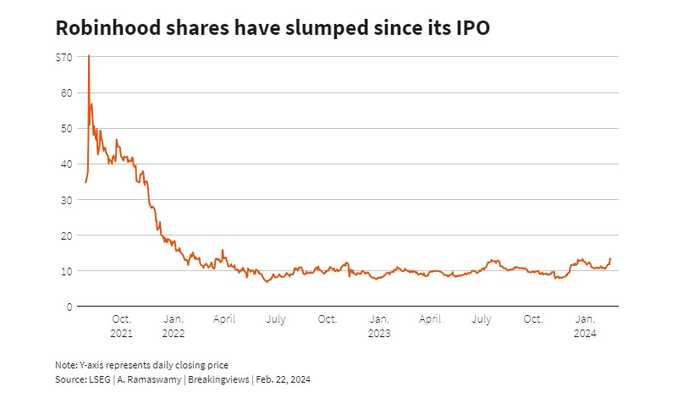

All this in theory would make Reddit’s mooted $5 billion valuation a stretch, but here’s where Reddit’s users could help. Offering them shares might give them an incentive to speak positively about the company’s prospects, not to mention indulge a little longer in free work. Reddit understands the power of this echo chamber, too. When Robinhood Markets offered a similar deal to its customers in 2021, it sold shares in an IPO that valued the trading firm at about $32 billion, almost triple its worth in a funding round the year prior. That’s in part thanks to the buzz that platforms like Reddit created, but Robinhood’s users had a vested interest too: They were also offered dibs on shares.

Advertisement

Other companies have done similar trades. Boston Beer, the maker of Sam Adams, gave guzzlers the chance to buy shares at a discount to the offering price in its 1995 IPO. Its stock was down some 60% in its first year of trading. It didn’t get back to its IPO price until 11 years on.

In the end, like with any IPO, the firm’s intrinsic value will dictate where the stock settles long term. Investors who held onto Robinhood shares are probably not feeling great: Shares are worth two-thirds less than the IPO price. Huffman may be dangling a benefit in front of his users. Really, though, the gift is to him.

Advertisement

23:19 IST, February 26th 2024