Published 19:25 IST, January 5th 2024

Shell chief executive has watched Exxon Mobil and Chevron undertake chunky deals in the Permian.

Advertisement

Wael you were sleeping. Wael Sawan is sitting on the sidelines. The chief executive of $214 billion European oil major Shell has watched Exxon Mobil and Chevron undertake chunky deals in the Permian, one of the world’s most profitable and fast-growing oilfields. In 2024 he could let his U.S. rivals get bigger, or he could amp up his pivot away from renewable energy and do a deal of his own.

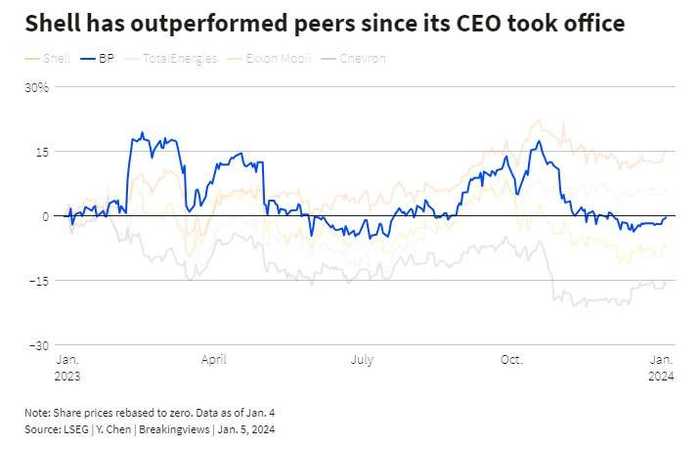

Plunging back into the Permian would be a striking and controversial move. In 2021, green pressures encouraged Sawan’s predecessor Ben van Beurden to sell assets there. But the Ukraine war seems to have reduced Shell’s enthusiasm for cutting oil output, and Sawan has also quietly dropped most green targets. Investors don’t seem to mind. Shell’s stock has risen 15% since Sawan took office in 2023, outperforming U.S. and European rivals. In contrast BP, which has more noticeably transitioned away from oil, has fallen less than 1% amid a struggle to find a CEO.

Advertisement

If Sawan sees a medium-term future for fossil fuels, he could do with more reserves. Shell estimates it will add another 500,000 barrels of oil equivalent per day by 2025 to prevent falling production, but beyond that the picture is fuzzier. Shell’s oil reserves are estimated to last nine years, 20% less than major peers, per Citi analysts. And compared to conventional drilling, the Permian requires a much shorter production cycle, reducing investment risks.

There’s also a ready-made target. After Exxon and Chevron’s mega-deals, Endeavor Energy Resources, one of the Permian’s top producers, is exploring a sale of up to $30 billion, Reuters reported. Unlike smaller competitors, Endeavor boasts mostly contiguous acreage in the core of the Midland Basin. At 331,000 barrels of oil equivalent per day, it’s already producing 25% more than in 2022, per Fitch Ratings. It also enjoys the highest operating margin of 81% per barrel of oil among peers rated by Fitch.

Advertisement

Shell could afford it. Net debt is just 0.6 times 2024 EBITDA, according to LSEG data. Even if Sawan paid all in cash, that would only rise to the same level as 2024 EBITDA, and Shell’s net debt as a percentage of total capital employed would rise to about 27%, still below 2019 levels. And Shell might also persuade Endeavor’s 85-year-old founder and majority owner Autry Stephens to take at least some of the payment in shares, as Exxon and Chevron did with their deals.

While the absence of already sated U.S. rivals and Endeavor’s sheer size might prevent a bidding war, there would be two catches. A $30 billion price tag would be 30 times Endeavor’s 2024 free cash flow, against Shell’s 7 times, per LSEG. Any perception Sawan is overpaying would amp up another, bigger headache: post-COP28, there’s now global recognition of the need to transition away from all fossil fuels.

Advertisement

That said, Sawan has arguably already taken the heat from green investors for his pivot back to fossil fuels. As such, he may just opt to join Exxon and Chevron and double down.

19:25 IST, January 5th 2024