Updated April 2nd, 2024 at 18:16 IST

Soho House’s private party may prove disappointing

The equity value of the $1.1 billion London-based group has more than halved since its 2021 New York listing.

- Business

- 3 min read

Advertisement

So-so house. Ron Burkle reckons Soho House is a fundamentally profitable business, if only investors could look at it in the right way. The company’s executive chairman might in theory have a point, but only if the group’s newer private members’ clubs become as popular as the older ones.

The equity value of the $1.1 billion London-based group has more than halved since its 2021 New York listing. A recent short-seller report hasn’t helped. Billionaire investor Burkle, who bought a controlling stake in 2012, last month said that the public market misunderstands the business. He could potentially support a take-private with the help of outside money. Board members and their affiliates own about 75% of the stock, and would keep control.

Advertisement

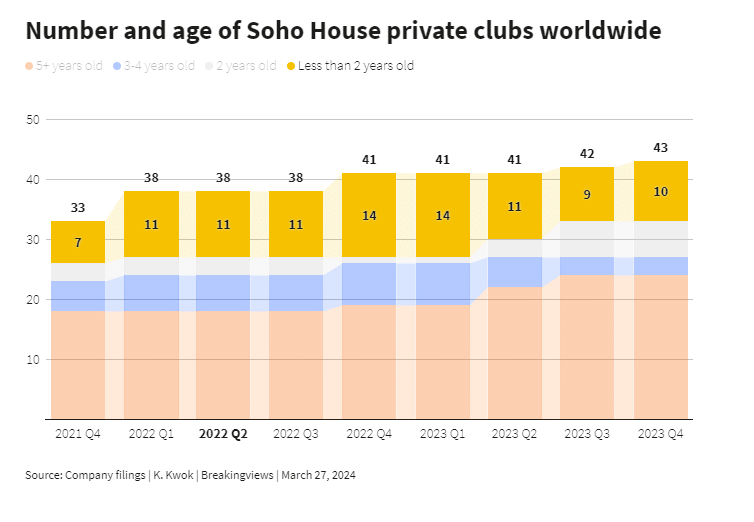

At first glance, Burkle’s profitability argument seems odd given Soho House’s consistent historic losses. His point, however, is that the red ink is down to growth. Soho House now has 43 clubs in 18 countries, compared with just 11 in four countries a decade ago. Newer additions, like Mexico City, seldom make a meaningful profit until they’ve been up and running for a few years.

Eventually, once the number of fee-paying members rises and the restaurants fill up, the money flows. The so-called “house-level contribution margin”, effectively the gross profit margin for an individual club, averages 35% for sites that are five or more years old, according to Burkle. Many of the most established clubs are well above that level.

Advertisement

It’s possible to imagine what the income statement might look like if all the new locations become as profitable as the mature ones, like the original London Greek Street site. The overall gross margin for the global chain of members’ clubs might then be in the region of 40%. Analysts reckon that, in 2026, Soho House’s general and administrative expenses and depreciation and amortisation could together swallow up roughly 20% of total revenue. Deduct those costs from the gross profit, and the group’s network of private clubs might be able to turn something like 20% of overall sales into operating profit, if all goes to plan.

That’s a big “if”. This scenario effectively asks Burkle’s would-be buyout partners to believe that Soho Houses in Bangkok, São Paulo, Manchester, Nashville, Portland and Stockholm will be as busy and profitable as the most established clubs. There’s no obvious reason why that should be the case. The newer cities are often less wealthy than London or New York, and tend to be places where Soho House has less cultural cachet. If the global sprawl ends up contributing little to the wider group’s earnings, the hoped-for profit might never materialise. Any backers of a Burkle-blessed buyout may then wish they’d never come to the party.

Advertisement

Advertisement

Published April 2nd, 2024 at 18:16 IST