Published 20:57 IST, January 18th 2024

China now accounts for almost 20% of the top line, quadruple the proportion in 2017.

Advertisement

Alpine heights. The initial public offering trail for Amer Sports warrants a black-diamond rating. The maker of Salomon skis and Arc’teryx parkas is sounding out new investors after a group led by Anta Sports Products bought it for about $5 billion in September 2019. Impressive growth in China should give the valuation a lift, but chunky debt and the Wilson brand slightly weaken the company’s competitive edge.

Amer has been on a tear. Its backers, which include Lululemon Athletica founder Chip Wilson and Asian buyout shop FountainVest, oversaw a 61% increase in adjusted EBITDA during the first nine months of 2023 from a year earlier, on the back of a 30% boost in revenue. A post-pandemic surge in China, where Anta is based, was a big reason.

Advertisement

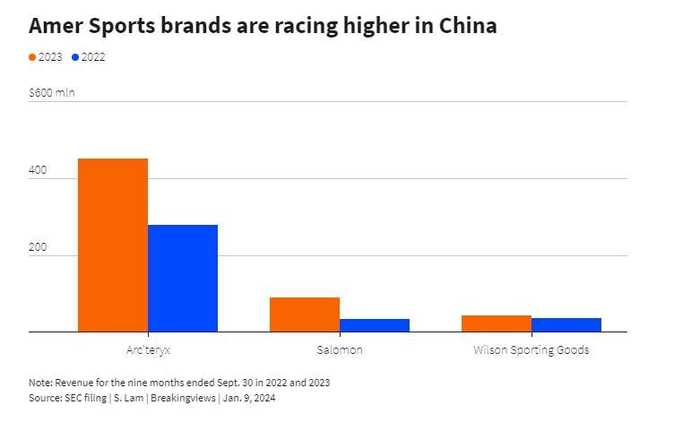

The country now accounts for almost 20% of the top line, quadruple the proportion in 2017. Amer’s upscale Arc’teryx brand, worn by mountain rescue teams, is doing especially well, generating nearly half its $940 million of sales through Sept. 30 in Greater China. Salomon, which also makes running shoes, grew at a roughly 170% clip in the region over the same span, albeit starting from a much smaller base, as winter sports become more popular.

The unit housing Wilson tennis rackets and Louisville Slugger baseball bats is steady, but hasn’t achieved the same success. Representing about 30% of sales, it is also Amer’s slowest growing business, at 10%, and counts just 7% of revenue from China. Moreover, the 6% operating profit margin from ball and racquet sports, is the weakest of the three divisions.

Advertisement

Assume Amer’s EBITDA growth rate cools off a bit, to 30%. Using an annualized figure for last year would imply about $730 million in 2024. Apply the approximately 20 times at which Lululemon, Nike and On trade, and Amer’s enterprise would be worth $15 billion. Such a valuation would be too generous, however.

While its three peers are net cash, Amer is likely to be carrying net debt of about $1.8 billion, equivalent to 3 times last year’s estimated EBITDA. The figure backs out related-party borrowing, much of which will be converted into equity or repaid with IPO proceeds.

Advertisement

Using Clarus and Topgolf Callaway Brands to apply a suitable discount imputes a multiple of 16 times, or roughly $12 billion. Amer’s equity would then be worth closer to $10 billion, and lead to a potentially smoother run.

20:57 IST, January 18th 2024