Published 19:47 IST, February 23rd 2024

The past year turned out well for the emerging-markets lender on most counts.

Advertisement

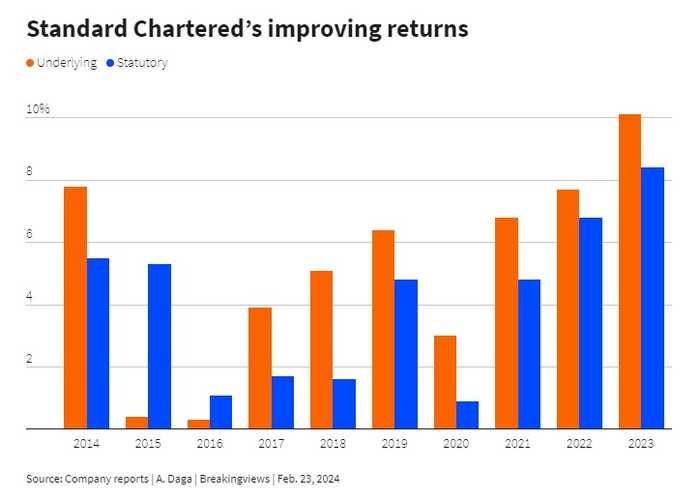

Show me the money. “The share price is crap.” So said Bill Winters, after the Standard Chartered CEO on Friday announced its highest return on tangible equity (ROTE) in a decade. While getting the Asia-focused bank past its 2023 targets earned the longtime boss a 22% pay hike, he keeps on giving investors reason to wrinkle their noses.

The past year turned out well for the emerging-markets lender on most counts. Revenue grew 13%, helped by net interest income swelled by rising interest rates. That helped the bank’s pre-tax profit jump 27%, ahead of market estimates. Fourth-quarter performance was marred by a $150 million charge related to the value of its stake in China Bohai Bank, but the bank had already taken a bigger writedown in the preceding quarter on the same holding. Meanwhile, a $1 billion buyback, a dividend hike and a 10% ROTE – the bank’s best performance in about a decade – explains why StanChart’s London-listed shares rose a decidedly non-crap 8% in a flat market.

Advertisement

Had Winters followed up his decent 2023 with some encouraging forecasts, StanChart wouldn’t deserve to trade at around half its 2024 tangible book value. But while he set a 12% ROTE target for 2026, the bank is no longer sticking to its previously flagged 11% target for 2024. He also scaled back a revenue growth target for this year in an environment of falling interest rates.

At 63% of income, costs remain high for an Asia-focused bank. StanChart’s presence in over 50 markets worldwide and a large staff of about 80,000 staff is another reason for investors to grumble, and there’s scope for Winters to be bolder. No wonder newly inducted chief financial officer, Diego De Giorgi, a former investment banker, is now targeting expense savings of $1.5 billion to simplify the group – though this will also involve costs of $1.5 billion.

Advertisement

For shareholders who have endured similar underwhelming objectives during Winters’ nine-year reign, it all feels a bit like déjà vu. Granted, Winters has repaired the bank’s finances, and boosted its lucrative wealth management business. But it’s all very well for the CEO to complain that perceptions of StanChart’s complexity and its sprawl are a big drag on its stock price, and for Chair José Viñals to gripe that the shares don’t reflect the progress the bank is making. Their bank needs to stop giving investors reason to be disgruntled.

19:47 IST, February 23rd 2024