Updated 3 February 2026 at 01:47 IST

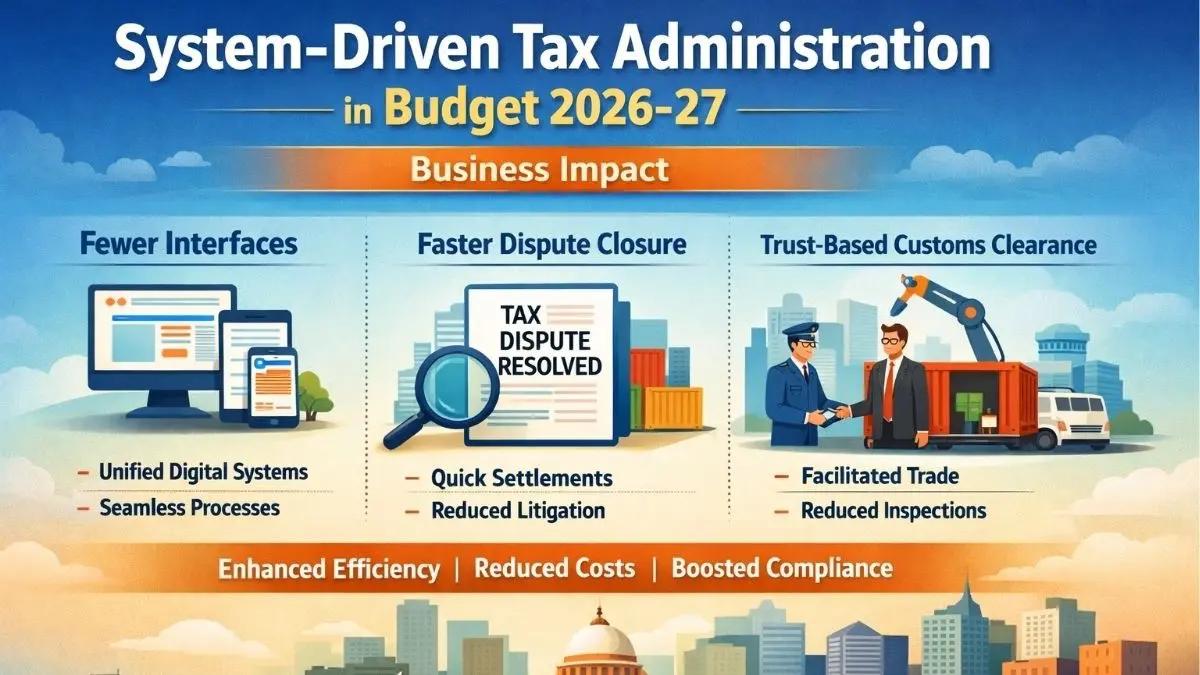

System-Driven Tax Administration in Budget 2026–27: Fewer Interfaces, Faster Dispute Closure & Trust-Based Customs Clearances

Budget 2026–27 introduces system-driven tax reforms with fewer interfaces, faster dispute resolution, automated compliance, and trust-based customs processes to ease business operations and improve efficiency.

- Republic Business

- 2 min read

1) Direct tax administration: fewer layers, faster closure

● Common order: Assessment + penalty as a single “common order” to cut multiple proceedings, reduce litigation cost, and speed up closures.

● Lower cash blockage during disputes:Pre-payment for first appeal reduced from 20% to 10%, calculated only on core tax demand. No interest liability on penalty amount during the period of appeal before the first appellate authority.

● Immunity route expanded (structured settlement): immunity framework proposed to extend to misreporting, subject to conditions and payment of additional income-tax.

● Technical defaults shifted from penalty to fee: several reporting/audit-related technical defaults proposed to be handled via fee, reducing discretionary escalation and improving predictability.

Advertisement

● Rationalised prosecution: decriminalisation for specified defaults and shift towards fine-only for minor offences, with graded prosecution and reduced maximum imprisonment.

2) “System-driven” compliance: reduced officer involvement where automation is introduced

● Automated lower/nil deduction certificate for small taxpayers, reducing the need to approach tax officers in such cases.

Advertisement

● Automated approvals for IT safe harbour, with approval without the need for a tax officer to examine, and continuity option up to 5 years once opted.

3) Indirect tax & trade facilitation: trust-based customs processes

● Deferred duty payment window for trusted manufacturers, supporting working-capital efficiency for compliant entities.

● Risk-system recognition for regular importers with trusted longstanding supply chains, intended to reduce friction and speed up compliant cargo movement.

● Electronic sealing for export cargo, enabling clearance from factory to ship, reducing time and touchpoints in the export chain.

4) Supply chain and non-resident facilitation (bonded zones)

● 5-year income-tax exemption for non-residents providing capital goods/equipment/tooling to toll manufacturers in a bonded zone.

● Safe harbour for non-residents for component warehousing in a bonded warehouse.

5) Practical business takeaways

● Less compliance drag: integrated orders and fee-based handling of technical defaults can reduce repetitive proceedings and uncertainty.

● Lower dispute-related cash lock-up: reduced pre-deposit and no-interest-on-penalty during first appeal can ease cash-flow stress.

● Fewer touchpoints: automation in certificates and safe-harbour approvals points to a system-first compliance direction.

● Faster logistics for compliant trade: risk-based facilitation + electronic sealing + deferred duty mechanisms can shorten cycle times for importers/exporters with strong compliance track record.

Published By : Shruti Sneha

Published On: 3 February 2026 at 01:47 IST