Published 14:08 IST, April 24th 2024

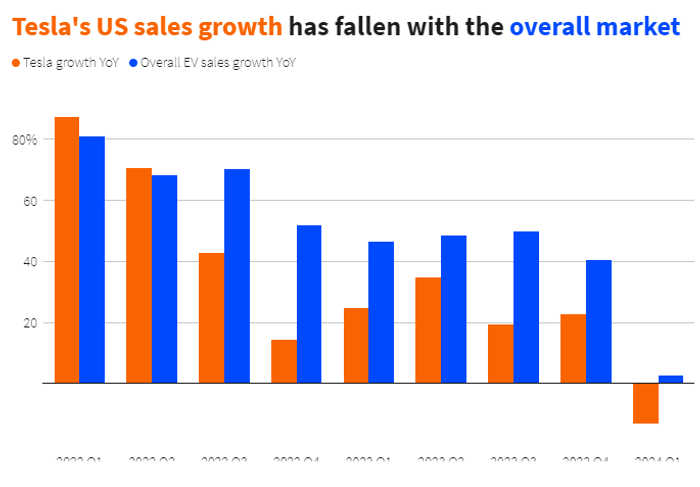

With electric sales now sputtering, Tesla’s growth has stalled.

Advertisement

Defying gravity. Tesla’s disappointing first-quarter earnings show just how kind the pandemic was to Elon Musk’s electric-vehicle maker. At its peak in 2022, when the electric automaker sported an over-$1 trillion valuation, it was wildly profitable and growing at breakneck speed. With electric sales now sputtering, Tesla’s growth has stalled. That leaves Musk trying to convince shareholders in a company now valued at $450 billion that the future will be as good as the past.

At the very least, they should hope it will be better than the present. Revenue of $17 billion for the three months ended March 31 was 11% less than analysts expected, according to LSEG. Earnings per share missed the mark too, and Tesla’s gross profit margin in its core business, adjusted for regulatory credit sales, is half what it was at its peak. In a further sign that Tesla’s luster is fading, sales fell year-on-year for the first time since Covid-19’s onset.

Advertisement

In retrospect, some kind of post-pandemic comedown was inevitable. During those years, consumers had more money than usual at their disposal, and Tesla had no effective competition. Its biggest U.S. rivals, General Motors and Ford Motor, were hobbled by parts shortages, and their combined share of the battery-powered vehicle market fell to below 5%. But eager early buyers are now exhausted. U.S. electric-vehicle sales notched their first quarter-over-quarter decline in years in 2024, according to Cox Automotive. Pricing has crashed back to earth.

Tesla still has a big hope: The company said that it will accelerate work on “affordable” versions of its cars, perhaps hinting at a long-awaited $25,000 vehicle, despite an earlier Reuters report that the effort had been nixed. Better yet, Musk says production will begin sooner than previously promised, though details on what exactly is in the works remain frustratingly vague. The dream is that this will make good on Musk’s mantra that Tesla is merely “between growth waves,” before wildly successful new models or self-driving robotaxis send it back to the stratosphere.

Advertisement

In the meantime, though, Tesla is investing more cash than it generates, and competitors are getting stronger. GM said in its own results on Tuesday that its combustion-engine business is going gangbusters, which provides boss Mary Barra with profit she can plow back into the company’s electric-vehicle business. No wonder Musk wants investors to focus on Tesla’s cheap-car future – however speculative – rather than its somewhat unappealing present.

14:08 IST, April 24th 2024