Published 19:15 IST, April 3rd 2024

TSMC has achieved its heft while keeping most of its factories and employees in Taiwan.

Advertisement

Chips on the table. Nvidia has ridden the wave of excitement about artificial intelligence to become the world’s third most valuable company. Yet founder Jensen Huang says the $2.3 trillion chip designer would not exist without Taiwan Semiconductor Manufacturing. His statement underscores how indispensable the $625 billion Taiwanese group is for the global technology industry.

TSMC has achieved its heft while keeping most of its factories and employees in Taiwan. Now U.S.-China tensions and the artificial intelligence boom are spurring it to venture overseas. How it navigates global expansion will influence the fate of entire industries and economies.

Advertisement

No chip is an island

Take apart any smartphone, computer, or other advanced electronic device, and there's good chance that the chip inside was made by TSMC. The company has a 60%-plus share of the global market for contract chipmaking and a monopoly over advanced microprocessors.

Advertisement

TSMC’s dominance owes much to its now-retired founder, Morris Chang, who pioneered a model which separated producing chips from designing them. Rather than spending billions of dollars to build their own factories – known as fabs – tech giants like Apple outsource manufacturing of microprocessors to TSMC, which can make them at a lower cost. Offshoring production to Asia has enabled the creation of a hyper-efficient industry that churns out over a trillion units a year, while making the Taiwanese company a lynchpin in the complex global semiconductor supply chain.

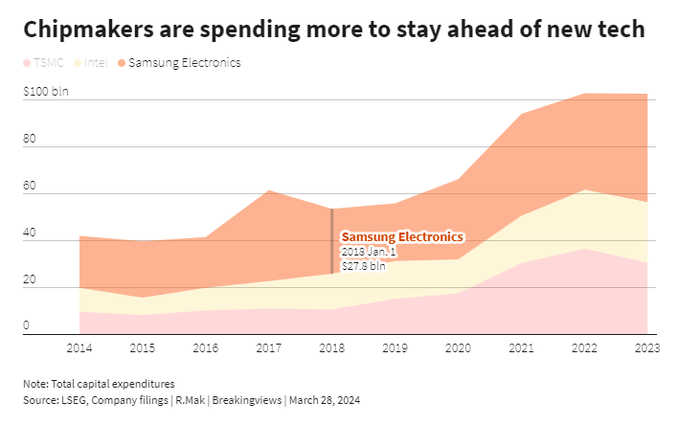

TSMC's tightly controlled factories are among the most profitable in the world, generating an annual gross profit margin of over 50% in each of the past three years. Financial success has allowed the company to pull ahead of rivals like Intel by pouring cash into developing new techniques. TSMC’s capital spending has averaged $30 billion a year since 2021, second only to chips-to-smartphone maker Samsung Electronics.

Advertisement

Two trends now threaten this status quo. China considers democratically governed Taiwan its own territory. A Chinese invasion would upend the Taiwanese economy and trigger a wave of sanctions from the U.S. and its allies. That could knock a tenth off global GDP as multinational firms and governments lost access to TSMC's chips, Bloomberg Economics estimated.

Meanwhile, breakthroughs in generative artificial intelligence, autonomous driving and other innovations require ever more processing power. The challenge of squeezing more transistors onto a single sliver of silicon is forcing manufacturers to pioneer new methods and materials.

Advertisement

That is pushing up costs. The next-generation lithography machine from ASML, the Dutch firm whose devices print miniscule circuit boards on silicon, costs over $300 million, more than double its current model. An advanced fab completed in 2026 will cost between $35 billion and $43 billion to run for a decade, according to Boston Consulting Group. That’s two-thirds more than today.

To hedge against geopolitical risks and stay abreast of new innovations, many governments are eager to bring chip manufacturing onshore. The U.S. CHIPS and Science Act offers $53 billion in grants plus another $24 billion of tax credits. The European Union followed up last year with a $47 billion plan.

Advertisement

An exercise in futility?

This explains why TSMC is transforming itself into a global manufacturer. Yet it has some catching up to do. Unlike other Asian companies such as Samsung or Japan's Toyota Motor, which began making cars in the U.S. in the 1980s, Taiwan's corporate champions have thrived by largely staying close to home.

TSMC also has painful memories of venturing overseas. Its factory in Washington state, set up over two decades ago, is a reminder of the steep learning curve. TSMC struggled with higher-than-expected costs, a chip market downturn and labour issues. "Initially it was chaos, it was just a series of ugly surprises", Chang recounted of the project that was meant to transform Portland's economy. After a few years of "trying to make it work", the company decided not to expand. Chang described making chips in the U.S. "a very expensive exercise in futility".

Chang’s successors, led by CEO Dr. C.C. Wei, may have better luck this time. TSMC is investing a total of $40 billion in two large, advanced semiconductor plants in Arizona. It has also teamed up with customers like Sony and Toyota to build new fabs in Japan and may have similar plans in Germany.

The U.S. projects have suffered delays, cost overruns, shortages of skilled workers, and clashes with local labour unions. And the government in Washington has yet to commit funds to TSMC. Still, the company is set to secure more than $5 billion in federal grants, Bloomberg reported in early March, citing people familiar with the matter. Additional tax credits should help make up for higher costs.

Moreover, TSMC’s dominance enables it to pass on higher expenses to customers like Apple keen to diversify supply chains from Asia. Red-hot demand for server chips used to power artificial intelligence models offers a further boost.

As a result, the company reckons it can stick to its long-term target for a gross profit margin of above 53% and a return on equity of 25% or more. Yet as TSMC diverts resources to replicating its Taiwanese operations around the world, spending on technological advances may slow.

The more immediate risk is a supply glut. Large chipmakers are racing to add new capacity on expectations that AI will drive demand for years. Though the new technology accounted for just 6% of TSMC’s top line in 2023, the company expects that to reach the high teens by 2027. Yet that is far from certain, as the business case for self-teaching models remains fuzzy.

TSMC’s dominance may also face challenges. Upstarts like the Microsoft-backed OpenAI, which operates the ChatGPT chatbot, are unhappy with the status quo. Its Chief Executive Sam Altman has complained about the cost of Nvidia's hugely sought-after chips and is in talks to raise trillions of dollars to boost the world's chip-building capacity, according to the Wall Street Journal.

Investors have their doubts. The AI craze has pushed up TSMC shares by nearly 50% over the past six months, but this largely reflects rising earnings expectations. The stock trades on 19 times forecast earnings for the next 12 months, according to LSEG data. That’s on a par with the five-year average but below Intel, which trades on a multiple of 28 times. Re-engineering itself may be TSMC’s most complex task.

19:15 IST, April 3rd 2024