Updated 7 June 2025 at 12:26 IST

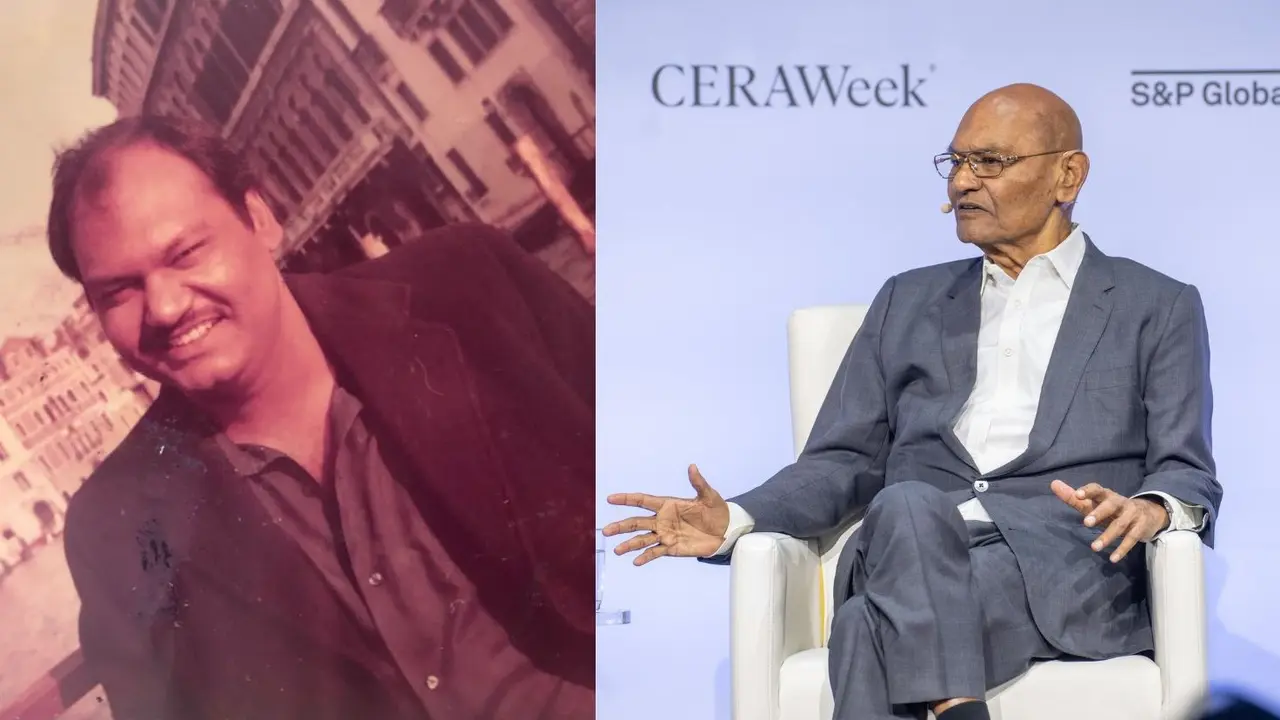

Vedanta’s Anil Agarwal: From Scrap Dealer & 9 Failed Businesses To Rs 35,000 Cr Net Worth — A Must-Read For Young Entrepreneurs

Anil Agarwal, the man behind Vedanta, turned a scrap business into a global empire worth Rs 35,070 crore. With no formal degree and nine failed ventures, his journey is a powerful lesson in grit, resilience, and never giving up.

- Republic Business

- 5 min read

Anil Agarwal, the founder and chairman of Vedanta Group, is a living example of what relentless perseverance, belief in dreams, and hard work can achieve. Born on January 24, 1954, in a lower-middle-class Marwari family in Patna, Bihar, Agarwal had humble beginnings.

According to Forbes, Anil Agarwal and his family have a net worth of about 4.2 billion US dollars, which is roughly Rs 35,070 crore in Indian rupees.

His father ran a small aluminium conductor business, and like many young Indians, Anil had dreams of making it big.

But life had other plans. “I didn’t complete my formal education. Not because I didn’t want to, but because life had other plans,” he tweeted.

Advertisement

From Scrap to Sterlite: 9 Failed Business

Agarwal began working at a young age, helping his father in the scrap business. In 1976, he took a big leap and acquired a small, struggling firm – Shamsher Sterling Cable Company. He admitted that he had no money to pay salaries or buy raw materials.

“I spent my days visiting banks to clear my payments, and my nights reviving the closed cable plant,” he recalled.

Advertisement

In the next ten years, he launched nine businesses — from magnetic wires to aluminium rods, even multiplexes with Warner Brothers. “All of them failed, one after the other. Still, I never gave up.”

Depression and the Toughest Years

The financial stress eventually took a toll, “For three years, I slipped into depression and no one knew about it. I was determined to get my life back on track, so I exercised and meditated…”

But he never stopped trying. His track record of turning loss-making businesses into profitable ones slowly started gaining attention.

Listing Vedanta in London

A pivotal moment came in 2003, when Vedanta became the first Indian company to be listed on the London Stock Exchange. “I was told that my vision was good, but it was a big risk as I was a first-timer. I had to earn their trust.”

At a networking event, he met top investors from JP Morgan, BHP, and Linklaters, who were going on a 100 km cycling trip to Oxford. Anil wasn’t sporty, but when challenged, he agreed to join. “I don't think I have ever felt that much pain, but the thought of not having my company listed here pained me more, so I pedaled even faster.”

Later, he and his wife Kiran hosted lavish Indian lunches for potential investors. “From feeding them Indian food to going on cycling trips, I did it all to make them see the potential of my company and my country.”

Global Growth and Major Acquisitions

From 2001 onwards, Vedanta made several big moves. In 2001 company acquired a majority stake in Balco, a government-owned aluminium company.

In 2007 it took over Sesa Goa, an iron ore miner. In 2011 Vedanta bought the Indian oil assets of UK-based Cairn Energy for $6.5 billion (approx. Rs 54,275 crore).

In 2018, Agarwal took Vedanta private, buying the remaining one-third stake for over $1 billion (Rs 8,350 crore).

Today, Vedanta has businesses in metals, mining, power, and oil across India and abroad. The group has also created a Rs 83,500 crore ($10 billion) fund with Centricus, a London firm, to invest in privatised Indian public sector companies.

Debt, Legacy, and Charity

Agarwal has cut $5 billion (Rs 41,750 crore) in debt, though the group still holds a similar amount. He owns a majority stake in India-listed Vedanta Ltd and has also pledged to donate 75% of his wealth to charity under the Giving Pledge.

“In order to succeed, you must first learn to fail,” he says. Despite his achievements, Agarwal has had his share of controversies — from legal battles in Goa and Orissa to protests against the copper unit in Tamil Nadu. Yet, he remains unfazed.

“I am a patriot of Vedanta. Patriots never give up in tough times. They work harder.”

Advice for Young Dreamers

“Start small, but just keep going. The growth curve goes up and down, but if you hold on strong, one day it will lift you up.”

“Success feels invisible in the beginning. It builds over time, with patience. The way to achieve it is commitment and consistency.”

From a scrap dealer in Patna to a global industrialist, Anil Agarwal’s journey is proof that grit and vision can turn even the most difficult paths into success stories.

Published By : Anubhav Maurya

Published On: 7 June 2025 at 12:19 IST