Published 19:55 IST, March 7th 2024

Nationwide Building Society on March 7 said it had reached a preliminary agreement to buy Virgin Money UK for 2.9 billion pounds.

Advertisement

Open wide. It’s the end of an era. If Nationwide Building Society succeeds in swallowing up Virgin Money for 2.9 billion pounds and a tasty premium, it will shatter regulators’ dreams of having bite-sized lenders competing with larger players. As costs and risks rise, banks are finding out that big is beautiful once again.

So-called challenger banks rose from the ashes of the 2008 financial crisis. After unwieldy lenders like Lloyds TSB and Royal Bank of Scotland got into trouble, regulators encouraged a new breed of smaller banks to provide diversification and competition. Many of these minnows have already disappeared. Last month, Barclays bought Tesco Bank for 600 million pounds. In December, Coventry Building Society made a 700 million pound offer for the Co-op Bank. Now Nationwide looks set to buy Virgin Money, one of the largest small banks left standing.

Advertisement

As it happens, Virgin Money is itself a rollup of minnows – it bought Northern Rock amid the 2008 financial crisis, then was absorbed into CYBG, a combination of Clydesdale Bank and Yorkshire Bank that maintained the Virgin brand. Even so it’s still a relatively small player, on which higher interest rates have piled pressure. Last November it reported a 24% slump in its 2023 pre-tax profit to 593 million pounds, below the 625 million pounds analysts had expected. In Virgin Money’s case, the bank offered higher loan-to-value mortgages and extended larger amounts of credit to customers so when interest rates ballooned to over 5%, more fell behind in paying interest on their loans.

Despite these issues, Nationwide is not getting Virgin on the cheap. Nationwide’s CEO Debbie Crosbie’s offer is pitched at a 38% premium to Virgin’s share price on Wednesday and is equivalent to 60% of Virgin’s tangible book value, similar to the valuation fetched by Tesco Bank. Yet last year the group only made a 4% return on tangible equity, and the deal isn’t likely to generate big synergies.

Advertisement

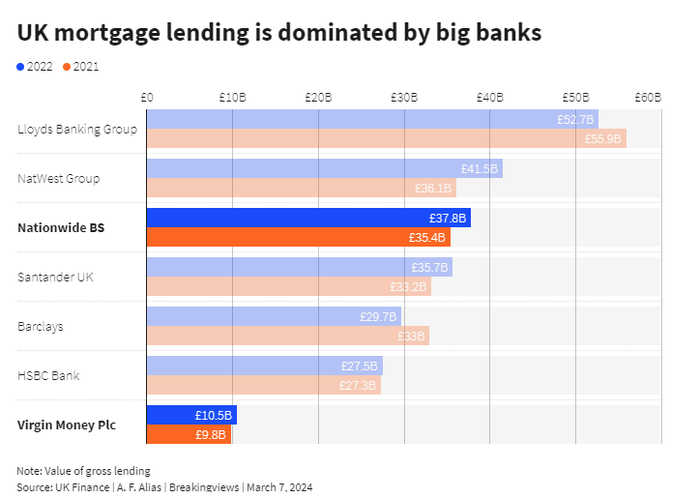

Still, the deal’s rationale makes sense. The combination will create the second-largest mortgage lender in the UK and allow the building society to better compete with rival Lloyds Banking Group. Virgin’s 9 billion pounds in business lending will also enable Nationwide to break into the market of lending to small firms. And although neither side has revealed the exact accounting gains, a person close to the situation said the negative goodwill benefit from buying the assets at a discount would exceed the hit from having to recognise some losses on Virgin’s balance sheet.

Bad lending and a lower customer quality meant the challenger banks didn’t challenge their bigger rivals. Last year, NatWest delivered a near 18% return on tangible equity. By adding Virgin, Nationwide will both cement its place among the UK’s big banks and end the country’s experiment with lending minnows. As long as regulators and CEOs ensure that large players don’t repeat the mistakes of 2008, that may not be a bad thing.

Advertisement

Context News

Nationwide Building Society on March 7 said it had reached a preliminary agreement to buy Virgin Money UK for 2.9 billion pounds. The all-cash deal would create Britain’s second-largest savings and mortgage provider. Nationwide said it would pay 220 pence for each Virgin Money share – a premium of 38% on the lender’s share price on March 6. Shares in Virgin Money were 36% higher at 216.5 pence at 1039 GMT on March 7. If the deal proceeds as announced, the new entity would have combined assets of approximately 366.3 billion pounds, with lending and advances of around 283.5 billion pounds. Nationwide said it did not intend to make any “material changes” to the size of Virgin Money’s 7,300-strong workforce in the near term.

19:55 IST, March 7th 2024