Updated December 28th, 2023 at 17:18 IST

Can India do without Chinese steel?

Indian steel sector is anticipated to post double-digit growth at 11-13 per cent for the third consecutive year, driven by the government's massive capex push

Advertisement

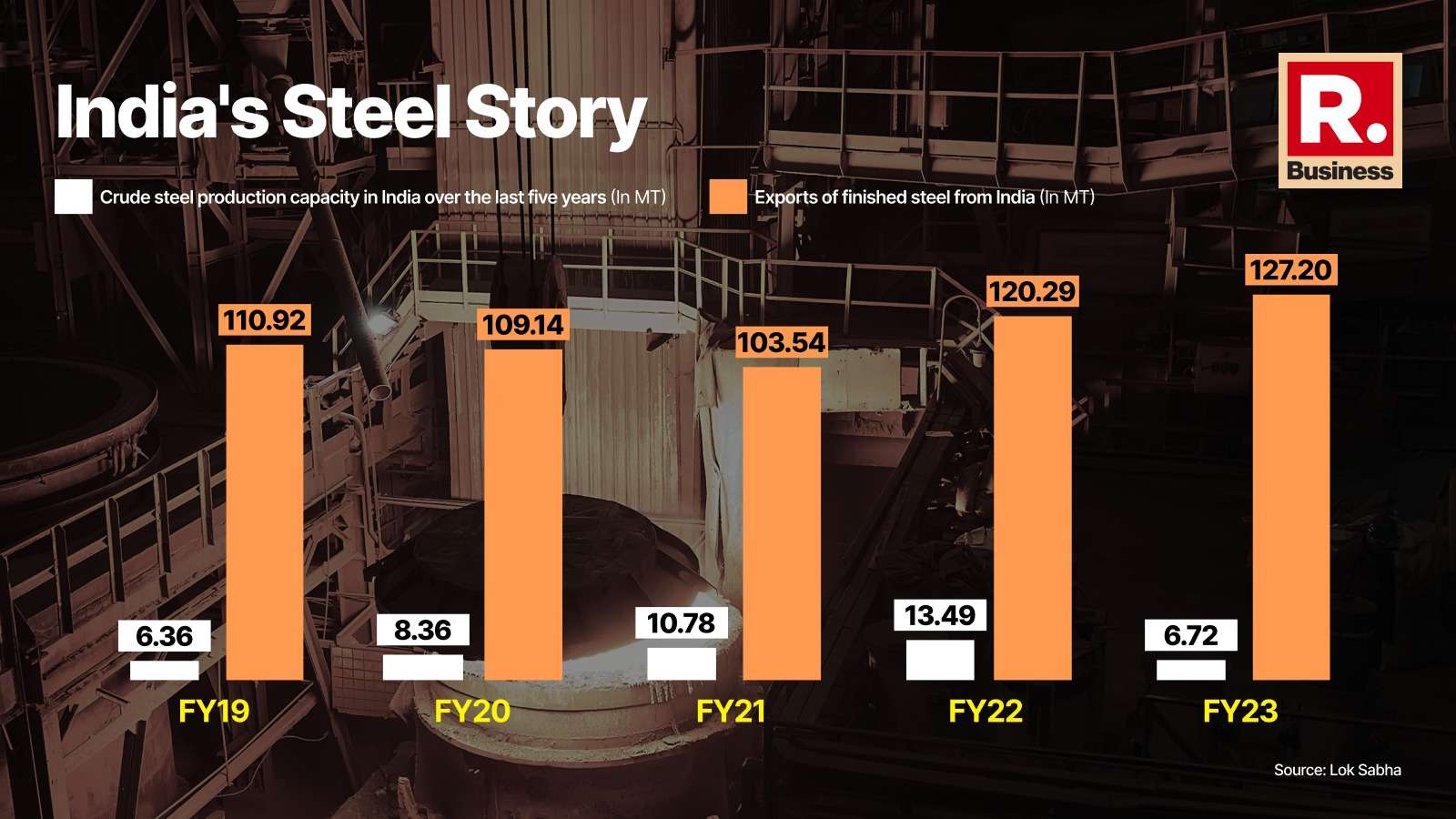

It was not long ago, when Chief Executive Officer of Tata Steel, TV Narendran raised concern about rising steel imports in India. The concern was valid as the predatory pricing from our neighbours was impinging hard on our domestic producers-thanks to China’s galloping steel exports and high price differential between international and domestic steel markets. India, the second largest consumer of finished steel in the world reported steel consumption of 119.89 metric tonne (MT) and per capita steel consumption of 86.7 kg in 2022-2023.

Source: Republic Business

Advertisement

On the flip side, the import of total finished steel in 2022-2023 was at 6.02 MT in 2022-2023. The steel industry, which is booming like never before, is anticipated to post double-digit growth at 11-13 per cent for the third consecutive year, driven by the government's massive capex push. The sector registered growth of 11.4 per cent in FY22, and 13.4 per cent in FY23, and now experts opine that in FY24, the sector is poised to grow upwards of 11-12 per cent again.

Irking Imports

Advertisement

The rise in imports is attributed by experts to cheap prices and wide price differential existing between domestic and international steel prices. It's the lucrative discounts on hot-rolled and cold-rolled (steel products) that is pushing a lot of buyers from India flocking to sign a flurry of import deals.

As far as imports are concerned, the biggest of all is from China. In the last 3-4 months, with the run rate of 8 MT per month, China is exporting around 100 MT exports annually. As per experts, the last time China exported at such levels was in 2015, as it was the peak of metal meltdown which plunged the entire industry into stress.

Advertisement

“If you look at the last 4-5 months, India has been a net-steel importer, if this kind of trend continues, then there is a situation when India can become a net-steel importer for a full year. This is happening for the first time in the last four years, the last time India was net steel importer is in 2019,” the person with knowledge of the matter told Republic Business.

“HR Coil, electrosteel, electric steel and HR coil are imported because of the price differential. When local manufacturers peg the prices, they are not in sync with international prices, then imports are encouraged,” Manish Garg Owner, Good Luck Steel, told Republic Business. According to Garg, large producers of HR coil manufacturers in India fix their prices higher, and immediately there is arbitrage available, so a lot of it gets imported because that is cheaper.

Advertisement

Poised to Post Robust Growth

“Steel sector is seeing the fastest pace of growth in the last fifteen years,” Ritabrata Ghosh, Vice President & Sector Head-Corporate Ratings, ICRA, told Republic Business. The sector is looking at this kind of growth in the last fifteen years. The people keeping a close eye on the growth trajectory of the sector believe that this kind of double-digit growth was last registered before the global financial crisis of 2008.

Advertisement

Source: Freepik

“Just before the Lehman brothers’ collapse, the growth was 13-14 per cent," Ghosh added further. Amidst dizzying growth, the steel sector is having one big challenge looming large that is to guard domestic producers from rising imports from various markets like China, South Korea, and Vietnam. Similarly, Chinese finished steel imports to India rose sharply by 48 per cent in the April- November period to 1.3 million metric tonnes, followed by South Korea.

In addition, various environmental norms have also posed a formidable challenge in front of the domestic steel producer. For example, between the January-November period this year, exports from China rose 35.6 per cent to 82.7 MT, and exports to India also increased. China has replaced traditional exporters to India in the last few months.

Advertisement

As of November, in the current fiscal year, India imported 4.26 MT of finished steel, up by 13.4 per cent on a year-on-year (YoY) basis, even as the exports dipped 6.2 per cent to touch 4.03 MT, in turn making the country a net importer of finished steel. Comparatively, steel imports remained around 5.6 per cent of the domestic demand at 6.7 MT in the previous fiscal years.

China’s Charming Steel

Advertisement

But the key question is why China’s steel hold such charm in India. The answer lies in China’s huge coking coal production capacity and advanced technology. According to industry insiders, in India, the steelmaker Iron ore is just 12-15 per cent of their total cost and the biggest cost incurred is on coking coal that is around 40-50 per cent of the total production cost.

As far as the key ingredient for steel production (coking coal) is concerned, India is heavily dependent on imports. On the flip side, China has a huge production base of coking coal, making steel production cheaper in China, compared to India. “In China, the disadvantage is that they don't have iron ore, they actually have to import iron ore, even if the cost of importing iron ore may be double but advantage is that 90 per cent coking coal demand is met domestically,” Ghosh of ICRA said. India largely fulfils its coking coal requirements through imports from Australia. But owing to frequent weather induced disruptions, there has been huge fluctuation in coking coal supply as well as coking coal prices. “The cost of steel production in domestic mills goes up in a much bigger way when prices of coking coal go up in Australia compared to Chinese producers. There is a price differential in coking coal from China and other sea borne markets,” Ghosh quipped.

Advertisement

Although India has abundant reserves of iron ore and coal, it has negligible reserves of coking coal. The National Steel Policy envisages that India will reach 300 million tonnes of steel-making capacity, and 68 per cent of that will be through the blast furnace route, which requires coking coal. This translates to about 200 million tonnes of steel being produced using coking coal, which means an annual consumption of about 180 million tonnes of coking coal.

Secondly, the cost of capital has a huge role to play in steel production which is higher in India when compared to its neighbouring countries. Steel is a capital-intensive sector. As per the PWC report, nearly Rs 7,000 crore is required to set up one tonne of steel-making capacity through the greenfield route. Naturally, the cost of financing any expansion or new steel capacity is usually through borrowed capital.

Source: Freepik

Advertisement

And in India the cost of finance is extremely high compared to the cost of finance in developed countries such as China, Japan and Korea. This adds about $30–35 to the final cost of steel. The cost of capital in India still remains significantly high and Indian steel makers continue to face a relative disadvantage vis-à-vis their competitors from the developed world.

Self-sufficiency in coking coal production, cutting edge technology, along with lower interest rates in China puts the country in an advantageous position when compared to India leading to a wide price differential, and which in turn boosting imports from China to India.

Advertisement

But, this October brought a sigh of relief. Since October, the price differential has declined. “In the fourth week of November 2023, Chinese HRC prices traded at US$565/ MT as against domestic HRC prices of Rs 55,000/MT. Domestic prices were at a US$3/MT marginal discount compared to imported offers in end November. However, in the first week of October 2023, before the domestic steel price corrections started, domestic HRC prices were trading at a US$60/MT premium over the landed cost of imported offers,” Ghosh opines.

“In November we researched and found that the gap has been bridged, incentive to switch from domestic to international market is not as high as it was before October,” Ghosh added further. This may in future lead to lesser imports from China.

Advertisement

Way Ahead

The steel sector going through the phase of phenomenal growth is staring at a possibility of robust growth only if the capital expenditure by the government maintains the same momentum like the ongoing fiscal. The steel industry’s capacity utilisation is steadily increasing signifying its miraculous growth. Currently, the capacity utilisation stands at 83 per cent, highest in the decade. According to Ghosh, whenever capacity utilisation increases beyond 80 per cent, you see investment uptick because growth outlook is good, their balance sheets are delivering.

The growth of the steel sector in 2024 is riding on the back of many things. The biggest concern is that in the election year government spending may slow leading to a slower growth in the domestic sector fuelled by government capex. “In the election year, if the government spending will not decline, you might see similar growth as usual as capital spending is concerned,” an industry insider told Republic Business. Some experts see the growth slower than 2023, but China is crucial for India’s steel sector. Some analysts believe that the lag effect of higher interest rates may lead to a recession in 2024, leading to a slowdown in the steel sector in India.

Advertisement

Published December 28th, 2023 at 16:56 IST