Published 21:53 IST, March 22nd 2024

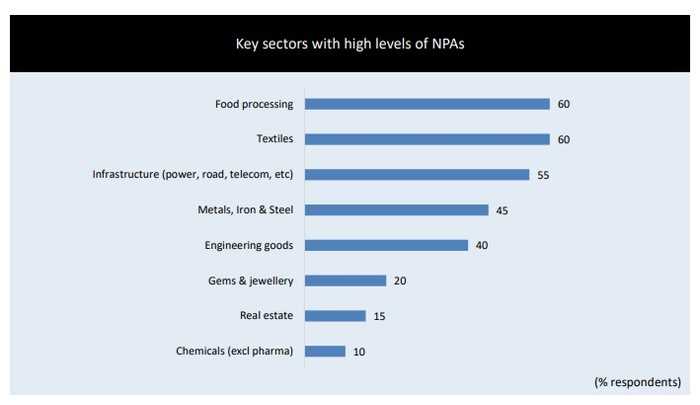

Despite the overall decline, challenges persist, especially in sectors such as Food Processing, Textiles, Infrastructure, Metals and Iron & Steel.

Advertisement

Trends in NPA: Non-performing assets (NPAs) have seen a significant reduction over the past six months, with a staggering 77 per cent of respondent banks reporting a decrease. This positive trend is particularly visible among Public Sector Banks (PSBs), where all respondents cited a decline in NPA levels. However, the picture is somewhat varied among Private Sector Banks, with 67 per cent witnessing a decrease and 22 per cent reporting an increase in NPAs, the FICCI IBA survey showed.

Source: FICCI- IBA Survey

Advertisement

Sectoral Pain Points

Despite the overall decline, challenges persist, especially in sectors such as Food Processing, Textiles, Infrastructure, Metals and Iron & Steel, and Engineering Goods, which continue to grapple with high NPA levels. However, there is a glimmer of hope as even in these sectors, there has been a noticeable decrease in NPAs over the last six months.

Advertisement

In terms of restructuring of advances, there has been a decrease in requests compared to the previous survey round. While 44 per cent of respondents reported a decrease, 17 per cent noted an increase. Notably, PSBs showed more significant improvements, with 50 per cent reporting a decrease in restructuring requests.

Looking ahead, there's optimism regarding credit growth in non-food industries, with a substantial 41 per cent of banks expecting growth above 12 per cent over the next six months. The sentiment is supported by government infrastructure development plans, which are anticipated to drive demand for infrastructure financing, with a striking 86 per cent of respondents predicting a rise in loans in this sector.

However, while the overall asset quality of Indian banks seems to be on an upward trajectory, concerns linger regarding specific sectors. Mixed responses were observed regarding sectors with high NPA risk over the next six months. For instance, Textiles and Garments, MSME, Agriculture, and Gems & Jewellery are identified as sectors with potential NPA risks.

13:35 IST, March 22nd 2024