Published 17:06 IST, April 19th 2024

The Indian government projected a 7.6 per cent GDP growth for the financial year ending March 2024, following an impressive 8.4 per cent GDP growth in the Oct.

Advertisement

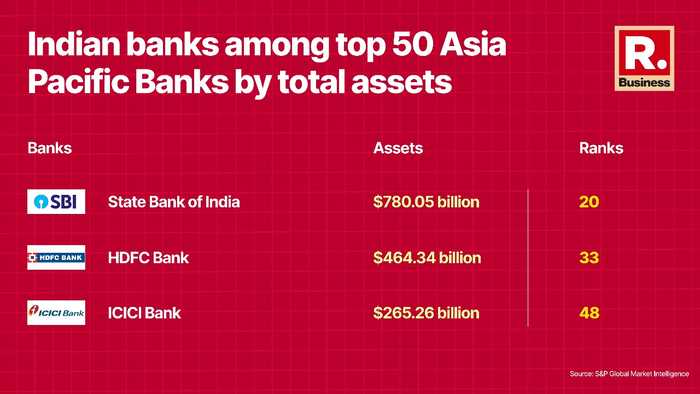

IndiaRising: Indian banks have emerged as standout performers in the Asia-Pacific region, showcasing impressive growth and resilience in recent years. In 2023, three Indian lenders secured positions in the top 50 banks by assets, marking a notable increase from two in the previous year.

The aggregate assets of these Indian lenders witnessed a remarkable surge of 50.5 per cent to reach $1.510 trillion in 2023. This significant growth was largely driven by the merger of HDFC Bank Ltd. with its parent company, Housing Development Finance Corp. Ltd., in July 2022. Following the merger, HDFC Bank's assets soared by 51.3 per cent to $466.35 billion, propelling the bank up 13 places to rank 33rd in the top 50 list.

Advertisement

India's robust economic environment, coupled with high credit growth, has fueled the remarkable performance of its banking sector. Credit growth in the country, currently the world's fastest-growing major economy, stood at 15.6 per cent as of December 29, 2023, compared to 14.9 per cent a year earlier, according to Reserve Bank of India data.

The Indian government projected a 7.6 per cent GDP growth for the financial year ending March 2024, following an impressive 8.4 per cent GDP growth in the October-to-December quarter.

Advertisement

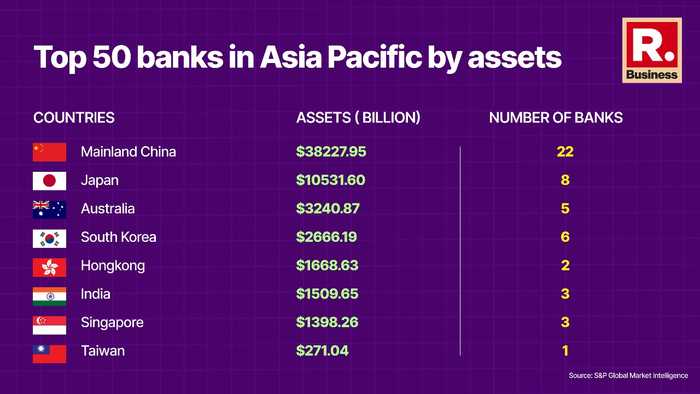

In contrast, Australian banks experienced mixed fortunes, with combined assets rising by 2.8 per cent to $3.241 trillion. Notably, Macquarie Group Ltd. dropped five spots to 50th in the list, with assets declining by 18.8 per cent to $254.63 billion in 2023.

Meanwhile, the aggregate assets of Singaporean banks rose by 3.7 per cent to $1.40 trillion. DBS Group Holdings Ltd. and United Overseas Bank Ltd. moved up in the ranking, while Oversea-Chinese Banking Corp. Ltd. fell three places to 37th.

Advertisement

Chinese Banks Dominate Top 50 Lenders in Asia-Pacific

In 2023, banks from mainland China maintained their dominance in S&P Global Market Intelligence's ranking of the top 50 lenders by assets in the Asia-Pacific region. Despite a slight decrease in the number of mainland China-headquartered lenders in the ranking, their aggregate assets surged by 7.4 per cent to reach $38.228 trillion.

Advertisement

These Chinese lenders secured the top four positions on the list, with six of them making it to the top 10. This remarkable performance comes amidst challenges in the property sector of Asia's largest economy, where real estate contributes nearly a quarter of the gross domestic product.

Industrial and Commercial Bank of China Ltd. retained its position as the largest bank in the region and globally in 2023. Agricultural Bank of China Ltd. moved up to the second spot, surpassing China Construction Bank Corp., while Bank of China Ltd. secured the fourth position. The "big four" Chinese banks collectively expanded their assets by 10.2 per cent to $21.905 trillion, with Agricultural Bank exhibiting the highest growth rate at 14.3 per cent.

Advertisement

China Bohai Bank Co. dropped out of the top 50 list in 2023, making way for ICICI Bank Ltd., based in India, which entered the ranking at the 48th position. This marks the only addition to the 2023 list compared to the previous year.

Angus Lam, senior economist for global intelligence and analytics at Market Intelligence, attributed the rapid credit growth as a key driver behind the expansion in assets for mainland Chinese banks. He noted that the largest Chinese banks typically boasted strong asset quality, ample liquidity positions, and robust capital buffers, enhancing their lending capabilities.

17:06 IST, April 19th 2024