Published 20:13 IST, February 14th 2024

Net interest margin is a key metric to gauge banks' profitability and growth.

Advertisement

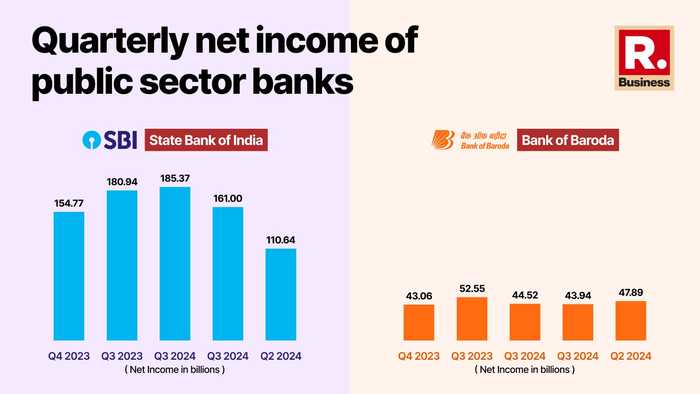

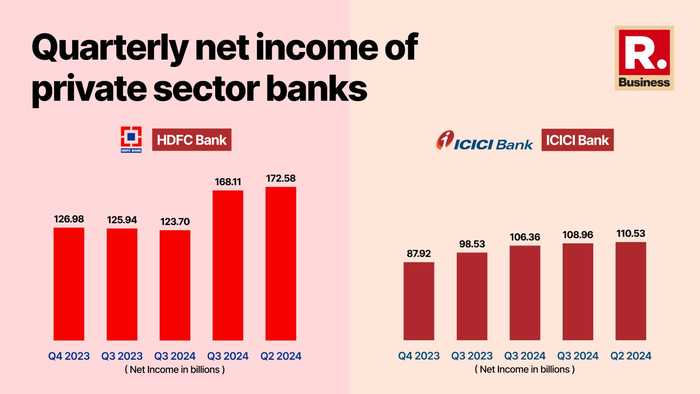

Indian banks dilemma: A few days back, banking secretary Vivek Joshi said that public sector banks are losing their saving accounts more rapidly than private banks. Joshi went on to add that the net interest margin of public sector banks is under pressure. The latest S&P Market Intelligence report on banks also said that in the 2023 December quarter, most major banks reported income gains, but net interest margins (NIM) declined due to tighter liquidity and rising funding costs.

Net interest margin is a key metric to gauge banks' profitability and growth, and this also shows the amount of money banks are earning on loans in comparison to the amount it is paying on interest on deposits. Simply put, the current squeeze in net interest margins of the banks is because bank deposit growth continues to lag behind credit growth. This is evident in RBI’s December data as well which showed that deposit growth in 2022-2023 stood at 11 per cent, behind credit growth of 15 per cent in the same period.

Advertisement

“Indian banks face a slowdown in growth and profit margins as deposits lag despite higher interest rates,” the recent S&P Market Intelligence report said. According to S&P Market Intelligence, in the December quarter, most major banks reported income gains but net interest margins (NIM) declined due to tighter liquidity and rising funding costs.

According to data compiled by S&P Global Market Intelligence, among large banks, only Punjab National Bank saw an increase in NIM for the fiscal third quarter. State Bank of India, India's largest bank, posted lower net profit after factoring in a Rs 7,100 crore expense related to wage bill increase.

Advertisement

Many reasons explain the dip in net interest income including treasury gains, margin contraction, asset quality issues for some institutions, and the impact of restrictions on alternate investment funds (AIFs) drove mixed results for Indian banks, according to Anand Dama, an Emkay Global analyst.

"We expect the growth and margins to moderate, though the pace of fall could be slightly lower for margins," Dama said in comments on Indian banks' fiscal third-quarter earnings.

The reason for subdued deposit growth among banks is also attributed to the inclination of people towards mutual funds to get more returns.

Advertisement

Credit growth

Indian retail lending is likely to continue to grow. Banks have seen an increase in retail lending despite central bank concerns about the rapid rise of unsecured loans.

“These reached 35 per cent of bank portfolios in 2023, up from 25 per cent in 2007, according to a Jan. 18 research paper by RBI employees. In November 2023, the central bank increased risk weights on unsecured personal loans in response,” the S&P Market Intelligence said.

Advertisement

CASA Ratio

The CASA ratio has also emerged as one of the key concerns in the banking system. Current and saving account ratio which shows the proportion of banks money in saving and current account. The higher ratio signifies a lower the funds rate, which in turn helps in the net interest margin.

According to data from CareEdge Ratings, the share of CASA deposits to total deposits of private sector banks contracted to 39.9 per cent at the end of December 31, 2023, compared to 44.5 per cent on December 31, 2022. For PSBs, it slipped to 40.5 per cent from 42 per cent.

Advertisement

The overall CASA ratio of the Indian banking system declined to 40.1 per cent from 42.8 per cent during the same period.

19:38 IST, February 14th 2024