Updated 26 January 2026 at 21:27 IST

True Beauty Actor Cha Eun-woo Apologises For Controversy Involving Tax Evasion Case, Takes 'Full Responsibility' In Official Statement

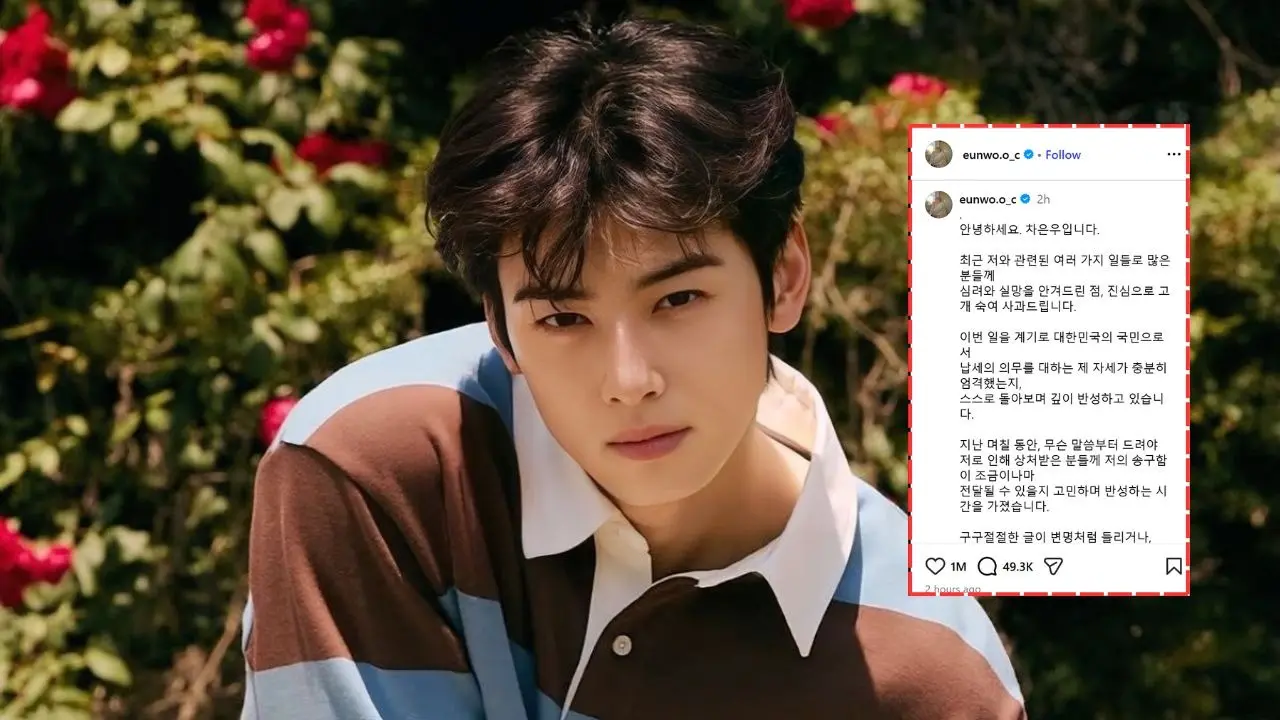

ASTRO’s Cha Eun-Woo has finally reacted to the $13.8 million tax evasion allegations linked to his agency, Fantagio, through a detailed statement on social media.

- Entertainment News

- 4 min read

Popular South Korean actor and singer Cha Eun-woo is under investigation by the National Tax Service over alleged tax evasion of more than 20 billion won(around £11.6 million, or roughly $13.6 million), connected to corporate entities linked to his family. As the matter grew, the True Beauty actor reacted to the allegations. In his official statement, he apologised to his fans and confirmed that he will fully comply with all tax-related procedures in the future.

Taking to Instagram, Cha Eun-woo shared a long note with a blank photo. His Instagram post read, “Hello, this is Cha Eun Woo. I sincerely bow my head and apologise for causing concern and disappointment to many people due to various recent matters involving me.

He went on writing, “Taking this incident as an opportunity, I have deeply reflected on whether my attitude toward my duty as a citizen of the Republic of Korea, particularly regarding tax payments, was sufficiently rigorous. For the past few days, I have spent time contemplating and reflecting on what words I should offer first to convey even a little bit of my regret to those who were hurt by me.”

He then wrote, “I was worried that a lengthy explanation might sound like an excuse or even cause further fatigue, but I came to the conclusion that it is my duty to address this matter directly and offer my apology. I am writing this after finishing my daily duties within the military unit. Currently, I am serving in the military, but this was by no means an intentional choice to avoid this controversy. Last year, I was in a situation where I could no longer postpone my military enlistment, and thus I enlisted without being able to complete the tax investigation procedures.”

Advertisement

“However, I deeply feel the responsibility for this misunderstanding, which also stemmed from my own shortcomings. If I were not a soldier at the moment, I would want to personally visit and bow my head to all those who were harmed by this incident. With that sentiment, I am writing this letter with all my sincerity. For the long period of the past 11 years, despite having more shortcomings than possessions, I was able to be in this undeserved position as “Cha Eun Woo” thanks to your unreserved love and support.”

He concluded by writing, “Therefore, I am indescribably sorry for not even being able to repay but to have caused great pain and fatigue to all those who believed in and supported me despite my inadequacies and to the many people I have worked with. I will faithfully participate in the tax-related procedures that will be conducted in the future. Furthermore, I will humbly accept the final decision made by the relevant authorities and take full responsibility accordingly.”

Advertisement

“In the future, I will reflect on myself more rigorously and live with a greater sense of responsibility, with the mindset of repaying the love I have received. Once again, I sincerely apologise for causing concern. January 26, 2026 Sincerely, Cha Eun Woo”

All about Cha Eun-woo's tax evasion case

According to reports in Korean media, Cha Eun-Woo is allegedly accused of creating a one-person agency to reduce his income tax burden. The allegations mirror earlier cases involving celebrities such as Sung Si-Kyung and Ok Joo-Hyun, where individuals reportedly used “one-person agencies” to secure tax benefits.

South Korea’s National Tax Service (NTS) has accused the idol of evading taxes worth $13.8 million.

Authorities have described this as one of the largest additional tax assessments ever issued to a Korean celebrity.

Get Current Updates on India News, Entertainment News, Cricket News along with Latest News and Web Stories from India and around the world.

Published By : Khushi Srivastava

Published On: 26 January 2026 at 20:56 IST