Updated 10 March 2020 at 11:02 IST

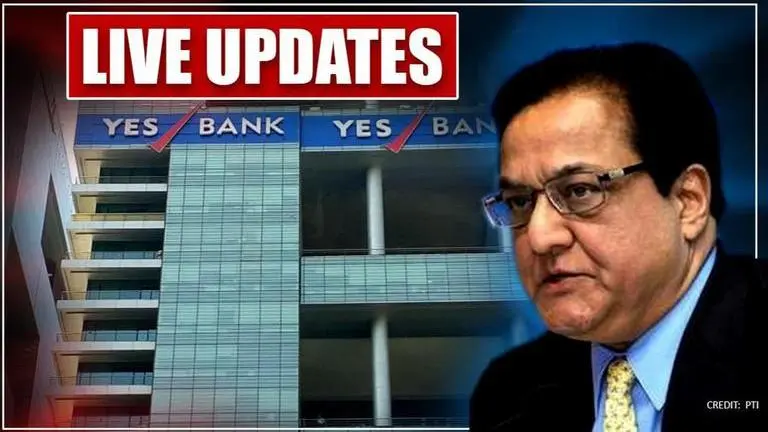

Yes Bank Crisis Live Updates:Relief to customers as Bank enables inward IMPS/NEFT services

On March 5, the RBI imposed a 30-day moratorium on Yes Bank restricting withdrawals to Rs. 50,000. Subsequently, the RBI unveiled a draft reconstruction scheme of Yes Bank & invited suggestions.

- Economy News

- 1 min read

10 March 2020 at 11:02 IST

CBI files case against on Rana Kapoor

After the ED, Central Bureau of Investigation (CBI) has filed an FIR against Rana Kapoor, Doit Urban Ventures Pvt Ltd , DHFL and Kapil Wadhawan under sections 420 - for cheating and various sections of Prevention of Corruption Act and 120 B criminal conspiracy, as per sources.

10 March 2020 at 11:02 IST

Rana Kapoor's daughter stopped at Mumbai airport

Yes Bank founder Rana Kapoor's daughter Roshni was stopped at Mumbai airport while leaving to London, as per sources. A look out notice has been issued against her. Look Out Circular has also been issued against entire Kapoor family including son-in-law Aditya

Advertisement

10 March 2020 at 11:02 IST

CBI raids 7 locations in Mumbai in connection with Rana Kapoor

Maharashtra: Central Bureau of Investigation (CBI) is conducting searches at seven locations in Mumbai, in connection with a case against #YesBank founder Rana Kapoor. https://t.co/PumEVaFNd9

— ANI (@ANI) March 9, 2020

10 March 2020 at 11:02 IST

'Won't Tolerate Corruption; Will Take Action': MoS Anurag Thakur

Union Minister of State for Finance Anurag Thakur on Monday said corruption will not be tolerated under the current BJP regime and the people responsible for the Yes Bank crisis will be punished. He added that the Central government has previously taken action against the people looting public money and they will do the same now and will continue to do so.

Speaking to reporters in Raipur, Thakur, when asked about Rs 600 crore alleged bribe to the family of Yes Bank's co-founder Rana Kapoor by DHFL said, "A lot will come out. We have asked for full details regarding the matter from the RBI. CBI and ED are doing their work. A lookout notice has been issued so that they do not run away and besides this, whatever investigation has to be done will be done."

Advertisement

10 March 2020 at 11:02 IST

Link Between Priyanka Vadra & Yes Bank's Rana Kapoor?

The BJP has alleged a sensational link between Congress leader Priyanka Gandhi Vadra and Yes Bank founder and former MD-CEO Rana Kapoor through an MF Husain painting, at a time when Kapoor is being probed by the ED. BJP's IT Cell Chief Amit Malviya alleged the link, claiming the purported sale of an MF Husain painting by Priyanka Gandhi Vadra to the arrested founder of Yes Bank, Rana Kapoor. As per sources, Priyanka Gandhi Vadra had sold the MF Husain painting of her father Rajiv Gandhi to Rana Kapoor for Rs 2 crore, the proof of which allegedly was her sale amount being openly disclosed in her income tax return of 2010.

10 March 2020 at 11:02 IST

List of accused in CBI's FIR

On March 7, CBI filed an FIR against Rana Kapoor, DoIT Urban Ventures, a company linked to Rana Kapoor family, DHFL, promoter of DHFL Kapil Wadhawan and others under sections 120 (B) (Criminal Conspiracy), 420 (Cheating) of Indian Penal Code along with section 7, 12 & 13 of Prevention of Corruption Act. The Economic Offence Wing (1) of CBI has lodged the FIR in New Delhi.

10 March 2020 at 11:02 IST

Yes Bank crisis

On Thursday, the RBI imposed a moratorium on Yes Bank, superseding its Board of Directors. In the meantime, former Chief Financial Officer of SBI Prashant Kumar has been appointed as its administrator. The withdrawals for customers have been capped at Rs.50,000. However, an exception can be made on the grounds of a medical emergency, higher education costs, marriage expenses, and unavoidable emergency.

The RBI has cited Yes Bank's “inability to raise capital to address potential loan losses” and “serious governance issues” as some of the reasons for taking action. The RBI on Friday unveiled a draft reconstruction scheme of Yes Bank in the public domain. Moreover, the RBI has invited suggestions and comments from the members of the public until March 9, 2020.

Salient features of the draft scheme

Under the ‘Yes Bank Ltd. Reconstruction Scheme, 2020’, the authorised capital of the reconstructed bank shall be altered to Rs.5,000 crore while the number of equity shares will be 2,400 crores. The investor bank shall hold 49% shareholding in the reconstructed bank. Moreover, it cannot reduce its holding below 26% before the completion of three years of infusion of the capital.

Once the scheme comes into operation, the RBI-appointed administrator will be replaced by a new Board on which the investor bank will have two nominee directors. Importantly, the draft states that no customer will be entitled to get any compensation from the reconstructed bank on account of the changes occurred by virtue of the scheme. On the other hand, all employees will continue in service with the same terms and services at least for a period of one year.

SBI seeks to buy a 49% stake in Yes Bank

Addressing a press conference on Saturday, State Bank of India Chairman Rajnish Kumar revealed that the SBI wants to pick a 49% stake in Yes Bank. Mentioning that the draft reconstruction plan had been unveiled by the RBI, he said that SBI's investment and legal team of SBI is conducting due diligence on it. Thereafter, Kumar stated that the SBI would get back to the RBI with its comments before the March 9 deadline.

Kumar explained the obligations that are a part of the draft scheme. He declared that the SBI would make an initial investment of Rs.2,450 crore in Yes Bank. In response to a specific question asked by Republic TV regarding the ED raids on Yes Bank founder Rana Kapoor, the SBI Chairman replied that an individual was different from an entity. He refuted the notion that the raids would have an impact on SBI’s investment in Yes Bank.

10 March 2020 at 11:02 IST

Yes Bank founder Rana Kapoor quizzed by ED

In a massive development, sources reported that Enforcement Directorate (ED) is carrying out searches at Yes Bank founder and former MD-CEO Rana Kapoor at his residential premises in Mumbai's Samudra Mahal. Sources also reported that a case of Prevention of Money Laundering Act, 2002 (PMLA) has been registered against him. The ED is the only central agency to have registered a case against Kapoor till now.

Mumbai: Rana Kapoor, #YesBank founder has been taken to Enforcement Directorate office for questioning. More details awaited. pic.twitter.com/IvjtSaWpEm

— ANI (@ANI) March 7, 2020

10 March 2020 at 11:02 IST

Yes Bank enables inward IMPS/NEFT services

Inward IMPS/NEFT services have now been enabled. You can make payments towards YES BANK Credit Card dues and loan obligations from other bank accounts. Thank you for your co-operation.@RBI @FinMinIndia

— YES BANK (@YESBANK) March 10, 2020

10 March 2020 at 11:02 IST

Rana Kapoor-DHFL link under scanner

The case against Kapoor is linked to the DHFL probe as the loans lent by the bank to the company allegedly turned nonperforming assets (NPA). According to the latest developments in the investigation, between April and July 2018, DHFL gave a loan worth Rs 600 crore to Doit Urban Ventures, which was reportedly controlled by the Rana Kapoor family. This loan was issued at a time when DHFL itself failed to pay back the debts it owned to YES Bank.

YES Bank's debt exposure in DHFL in terms of short-term debentures during this time period in 2018 was Rs 3,700 crore. At the same time, YES Bank had also given a loan worth Rs 750 crore to RKW Developers. DHFL and RKW Developers are both under the ED scanner for financing a deal between Dheeraj Wadhawan and Kapil Wadhawan of DHFL and Dawood Ibrahim's aide Iqbal Mirchi, an alleged Indian drug trafficker who died in 2013.

10 March 2020 at 11:02 IST

Manish Tewari demands urgent meeting of Parliamentary Standing Committee on Finance

Congress leader and Lok Sabha MP Manish Tewari wrote a letter to fellow parliamentarian Jayant Sinha on Saturday, urging him to convene an urgent meeting of the Parliamentary Standing Committee on Finance in the wake of the Yes Bank crisis. Currently, Sinha is the chairperson of this committee. Tewari stated that the imposition of a moratorium on Yes Bank along with the collapse of DHFL and IL&FS was a warning sign for the economy.

My request to Hon’ble @jayantsinha to kindly convene the Parliamentary Standing Committee of Finance to take stock of the Yes Bank Crisis that has impacted 29 Lakh Depositers at the earliest. pic.twitter.com/S0jGhmazXO

— Manish Tewari (@ManishTewari) March 7, 2020

10 March 2020 at 11:02 IST

BJP leader Shahnawaz Hussain assures depositors

BJP leader Shahnawaz Hussain on Saturday assured depositors of Yes Bank to not panic over the situation and stated that the government is looking after the matter. On Thursday, the RBI imposed a 30-day moratorium on Yes Bank, restricting the withdrawal limit for customers to Rs 50,000. The Opposition has been constantly criticising the Centre over the same.

However, Finance Minister Nirmala Sitharaman on Friday assured the depositors that all their money is safe. She stated that she is in constant touch with the Reserve Bank of India and a resolution will be found soon. The Finance Minister added that she has been personally monitoring the situation for the past couple of months along with the RBI.

10 March 2020 at 11:02 IST

P Chidambaram terms SBI plan as 'bizarre'

Addressing a press briefing, senior Congress leader and Rajya Sabha MP P Chidambaram termed the plan of SBI's investment in Yes Bank as "bizarre". Instead, he suggested that the SBI should take over Yes Bank and ensure the money of the depositors is returned. Moreover, he called upon the SBI to make every possible effort to recover the outstanding loans of Yes Bank.

Former Finance Minister & Congress leader P Chidambaram: Simultaneously, State Bank of India (SBI) should make every effort to recover as much as possible of the outstanding loans of Yes Bank. https://t.co/6aDaYFUmc0

— ANI (@ANI) March 7, 2020

10 March 2020 at 11:02 IST

Yes Bank Crisis LIVE Updates: Yes Bank officials under scanner

After ED quizzed ex- Yes Bank CEO Rana Kapoor, sources reported that other officials are also under EC scanner. On March 5, the RBI imposed a 30-day moratorium on Yes Bank restricting withdrawals to Rs. 50,000. Subsequently, the RBI unveiled a draft reconstruction scheme of Yes Bank & invited suggestions.

10 March 2020 at 11:02 IST

Rana Kapoor Arrested

After being arrested by the Enforcement Directorate under the Prevention of money laundering act (PMLA), Yes Bank founder Rana Kapoor on Sunday was confronted by Republic TV while visiting the hospital for physical examination. Visuals show the ex-MD of Yes Bank hiding his face and being shunted into the car by ED officials, proceeding to the hospital. He is currently being taken from the hospital to be produced in court on Sunday.

ED probe into Rana Kapoor

Rana Kapoor was questioned by the ED sleuths for over 20 hours after the central agency raided his residence on Friday night. As per reports, the Enforcement Directorate is investigating the case of alleged kickbacks of Rs 600 crore received by a shell company controlled by the Yes Bank founder and his two daughters. Media reports suggest that the shell company Doit Urban Ventures received kickbacks from Dewan Housing Financial Corporation Ltd (DHFL) for loans worth Rs 4,450 crore granted by Yes Bank. The ED suspects that the amount of Rs 4,450 crore was siphoned off by DHFL through 79 dummy companies, including Doit Urban Ventures.

10 March 2020 at 11:02 IST

ED seeks 5 day custody

Court hearing begins as ED asks for 5 days custody of Yes Bank founder Rana Kapoor. But Kapoor claims he is unwell and is ready to submit his passport and promises to not leave the country.

10 March 2020 at 11:02 IST

Judge gives ED custodial interrogation till 11 March

The judge pronouncing the verdict says,"If the accused is given for investigation, it becomes duty of the agencies to take care of the accused and medical treatment if required. If custody granted, considering the nature of offence, and amount involved, the accused shall take it as an opportunity". He then granted ED custodial interrogation of Rana Kapoor till 11 March.

10 March 2020 at 11:02 IST

ED officials reveal investments under probe

Investments worth over Rs 2,000 crore, 44 expensive paintings & dozen alleged shell firms part of ED investigations against #YesBank founder Rana Kapoor: Officials

— Press Trust of India (@PTI_News) March 8, 2020

10 March 2020 at 11:02 IST

Working to restore all services: Yes bank administrator

Yes Bank's depositors may be able to start full withdrawals by the end of this week. "The lender is working to restore all banking services for its customers as soon as possible. I think we are going to declare our results on March 14th," said Yes Bank official to PTI.

10 March 2020 at 11:02 IST

Search by CBI is underway at seven places in Mumbai

Searches underway at DHFL office, office of Doit Urban Ventures (India) Pvt Ltd, office of RKW Developers Pvt Ltd, residence of Rana Kapoor in Worli, residence of Kapil Wadhawan in Bandra West, Rana Kapoor's daughters Rakhi Kapoor Tandon's & Radha Kapoor Khanna's residences. https://t.co/xLTXREeg16

— ANI (@ANI) March 9, 2020

10 March 2020 at 11:02 IST

CBI issues Look Out Circular against Rana Kapoor & others

CBI issues Look Out Circular against #YesBank founder Rana Kapoor, his wife Bindu Rana Kapoor, their daughters Roshni Kapoor, Rakhee Kapoor Tandon & Radha Kapoor, chairman-MD of DHFL Kapil Wadhawan, and Director of RKW Developers Pvt Limited Dheeraj Rajesh Kumar Wadhawan. pic.twitter.com/hQzV24ojWA

— ANI (@ANI) March 9, 2020

Published By : Digital Desk

Published On: 7 March 2020 at 14:12 IST