Updated 1 February 2025 at 22:46 IST

Short-Term Loan Limit Under Kisan Credit Card Increased from Rs. 3 Lakh to Rs. 5 Lakh

Short-Term Loan Limit Under Kisan Credit Card Increased from Rs. 3 Lakh to Rs. 5 Lakh

- India News

- 2 min read

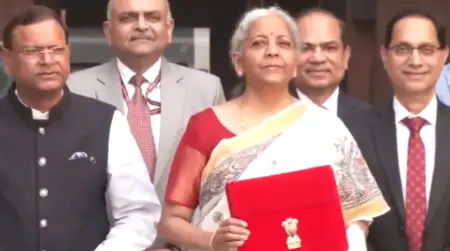

Budget 2025: In a major boost to farmers and allied sector workers, Union Finance Minister Nirmala Sitharaman on Saturday announced an increase in the interest subvention scheme limit for the Kisan Credit Card (KCC) from ₹3 lakh to ₹5 lakh.

"Kisan Credit Card facilitates short-term loans for 7.7 crore (77 million) farmers, fishermen, and dairy farmers. The loan limit under the modified interest subvention scheme will be enhanced from ₹3 lakh to ₹5 lakh for loans taken through the KCC," Sitharaman said while presenting the Union Budget 2025.

It is likely to strengthen rural economies and ensure long-term agricultural growth.

The Kisan Credit Card (KCC) scheme, launched in 1998, provides short-term crop loans to farmers engaged in agriculture and allied activities at a benchmark rate of 9 percent.

Advertisement

The government offers an interest subvention of 2 percent and a prompt repayment incentive of 3 percent, effectively making credit available at a subsidized rate of 4 percent per annum.

As of June 30, 2023, the scheme had over 74 million active KCC accounts, with a total outstanding credit of ₹8.9 trillion. Farmers looking to apply for a Kisan Credit Card must meet specific eligibility criteria, including being an owner-cultivator, sharecropper, tenant farmer, or a member of a self-help group or joint liability group.

Advertisement

They should be engaged in crop production or allied activities such as animal husbandry, as well as non-farm activities like fishing. Previously, loans exceeding ₹1.60 lakh required a guarantee. However, the Reserve Bank of India ( RBI ) recently raised the guarantee-free loan limit to ₹2 lakh, allowing farmers to avail loans up to this amount without collateral.

Farmers interested in enrolling in the KCC scheme can visit the official website of their preferred bank, navigate to the Kisan Credit Card section, and apply online.

They need to fill out the application form with personal information, farming details, and financial records.

Upon submission, eligible applicants will be contacted by the bank within three to four working days for verification and further processing.

Get Current Updates on India News, Entertainment News, Cricket News along with Latest News and Web Stories from India and around the world.

Published By : Isha Bhandari

Published On: 1 February 2025 at 11:20 IST