Updated March 21st, 2024 at 11:40 IST

Why Only Tax Temples?: Karnataka Governor Refuses to Sign Temple Tax Bill

he bill sparked a huge controversy in Karnataka, with the opposition BJP alleging that the Siddaramaiah govt is indulged in rolling out "anti-Hindu" politics

Advertisement

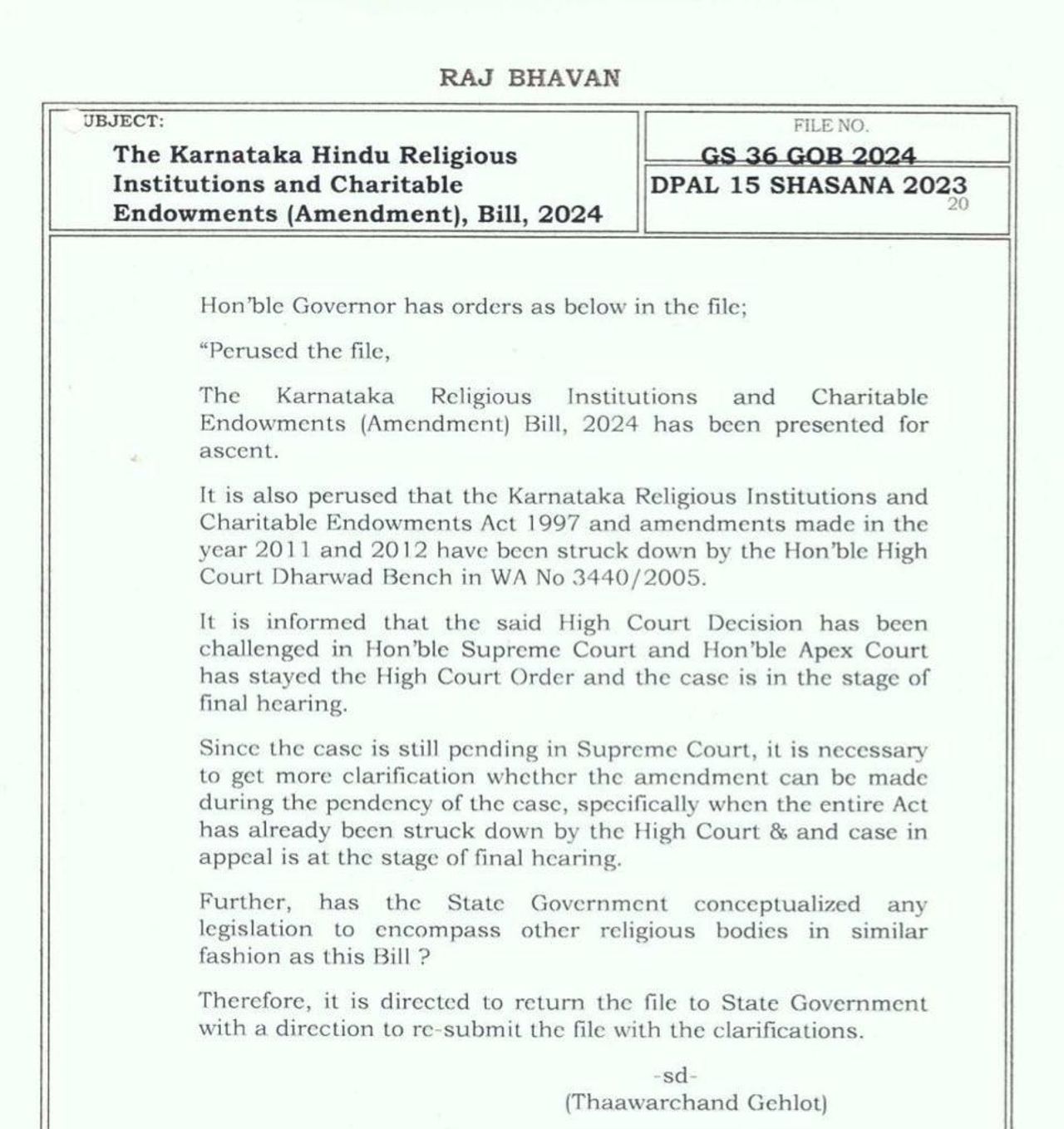

Bengaluru: In a big setback for the Karnataka government, Karnataka Governor Thawar Chand Gehlot has refused to sign the Temple Tax bill Bill, questioning as to why only Hindu temples are being taxed. Emphasising that it is discriminatory to only a particular religion, he noted that all religious bodies should be taxed under the bill.

In an embarrassment over the Religious Endowment Bill, Governor Thawar Chand Gehlot withdrew the Karnataka Hindu Religious Institutions and Charities Bill.

Advertisement

The governor questioned whether other religious organisations will be included in this bill. The governor further questioned whether the state government has any concept of making any act on the model of this bill by including the amendment brought in relation to Hindu religious institutions.

The Governor issued the state government with a direction to re-submit the file with clarifications.

Advertisement

Refusal of the Governor to sign the amendment bill mandates that the 'general collection fund' accumulated in the rich temples under the jurisdiction of the Mujarai department be used for non-revenue 'C' category temples.

Advertisement

The bill mandated a 10 per cent tax on cash-rich Hindu temples.

Advertisement

The bill proposed to collect 5 per cent from temples whose gross income is between Rs 10 lakhs and less than Rs 1 crore. For temples whose annual income is above Rs 1 crore, the state government would collect 10 per cent of the funds. The proposal was a part of the state government’s ‘Karnataka Hindu Religious Institutions and Charitable Endowments Bill 2024’, mandating the state government to charge 10 per cent tax from temples generating revenue exceeding Rs 1 crore and 5 per cent from shrines with revenue of between Rs 10 lakh and Rs 1 crore. The bill also sought the creation of state-level and district-level committees to "scrutinize, review and submit" proposals on infrastructure development for pilgrims.

The bill sparked a huge controversy in Karnataka, with the opposition BJP alleging that the Siddaramaiah dispensation is indulged in rolling out "anti-Hindu" policies.

Advertisement

Published March 21st, 2024 at 10:00 IST