Updated 11 April 2025 at 18:16 IST

US-China Trade War: How China Plans to Make America Feel the Heat

China has now raised its own tariffs to 125%, signaling the opening of a new, more intense phase of the U.S.-China trade war.

- World News

- 3 min read

US President Donald Trump’s latest round of sweeping tariffs on Chinese goods — 145% in some cases — has triggered an aggressive response from Beijing. China has now raised its own tariffs to 125%, signaling the opening of a new, more intense phase of the U.S.-China trade war.

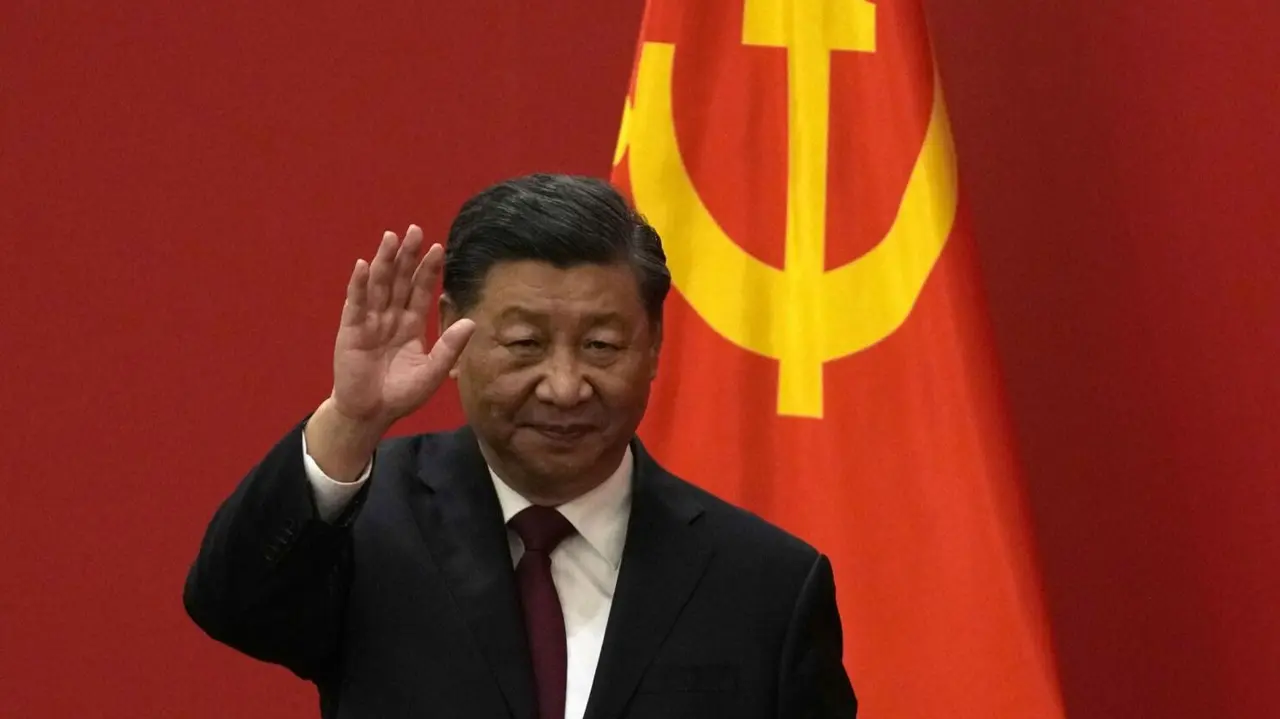

And Chinese President Xi Jinping appears prepared to make sure the pain is felt across America — from store shelves to soybean farms and Hollywood studios.

Consumers May Pay the Price

Trump’s tariffs are expected to make Chinese-made products — everything from toys to smartphones — significantly more expensive for American shoppers. And Xi doesn’t even need to retaliate here; the U.S. measures themselves will likely do the damage.

Trump has promised that tariffs will spark a manufacturing revival in the U.S., but even if that happens, Americans may be looking at years of higher prices in the meantime.

Advertisement

Still, there’s a possible off-ramp. Trump has said he's open to negotiating with Xi — a signal that a truce might still be on the table if talks resume.

U.S. Farmers and Exporters on Edge

China is already a major buyer of U.S. agricultural products and energy, and that relationship is now under strain. Xi could turn to Brazil for soybeans — as happened during the last trade war — and apply pressure on other American exports like oil and aircraft.

Advertisement

During trade war 1.0, the Trump administration had to bail out American farmers with a $28 billion aid package. This time, the stakes — and the tariffs — are even higher.

U.S. Companies Face Direct Retaliation

China has named 12 American firms to an export control list and banned six major defense and aviation companies from operating in China. An antitrust investigation into DuPont is also underway, and big names like Google and Nvidia have faced similar scrutiny.

These targeted moves are part of a refined playbook Beijing has developed over the years. And many American corporations — heavily invested in the Chinese market — could soon find themselves caught in the crossfire.

Rare Earth Restrictions Could Hit Hard

Last week, China tightened export rules on rare earth minerals, which are essential for a wide range of U.S. technologies — from semiconductors to wind turbines to missiles.

Although cutting off these exports would also hurt Chinese producers, the threat itself is enough to make Washington nervous.

Will China Dump U.S. Debt?

China holds over $760 billion in U.S. Treasury bonds. Economists call it the “nuclear option” — selling off that debt en masse could destabilize the U.S. economy.

Most believe Xi won't go that far because it would also hurt China. But just having that leverage adds to Beijing’s arsenal.

Currency and Hollywood

Beijing could also devalue the yuan to make Chinese exports more competitive and blunt the effects of Trump’s tariffs. So far, it has kept the currency stable, while promoting the use of the yuan in global trade.

On another front, China is reducing the number of Hollywood films it allows to screen in the country. According to reports, a full ban could be in the works. Shares in U.S. entertainment companies are already falling on that news.

The Bottom Line

Trump’s tariff campaign is designed to weaken China’s economy. But Xi has a long list of ways to make sure Americans feel the squeeze, too.

With no clear end in sight, both sides are preparing for a prolonged battle — and consumers, farmers, and companies in both countries could soon be caught in the middle.

Published By : Sagar Kar

Published On: 11 April 2025 at 18:16 IST