Published 14:28 IST, March 22nd 2024

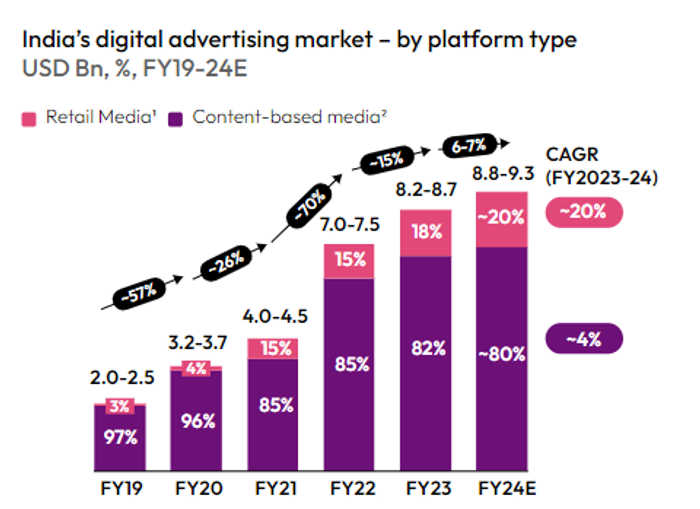

As per the report, digital advertising spending in FY24 is expected to reach $8.8-9.3 billion, driven by evolving consumer habits and sector-specific demands.

Advertisement

Digital advertising growth FY24: The COVID-19 pandemic fuelled an unprecedented surge in advertising expenditure, primarily driven by digital advertising, as online consumption soared during lockdowns. However, the growth has stabilised since FY23, with a projected muted growth of 5.5-6 per cent in FY24, according to a report by Redseer.

Factors characterising the market

- Shift in audience mix: Tier 2+ cities joining the digital population, leading to increased demand for regional content and platforms.

- Consumer preferences: Seismic shift towards digital media platforms, augmenting demand for digital advertising.

- Rise of digital-first brands: Emergence of numerous digital-first brands driving advertising expenditure in pursuit of customer engagement.

- Organised market growth: Increasing investment by brands across consumer sectors to boost customer engagement.

Challenges faced in current fiscal

- Stagnant demand: Economic slowdown and sluggish spending patterns affecting overall market growth.

- Global factors: Impact of rising interest rates and geopolitical tensions on advertising expenditure.

- Regulatory changes: Introduction of GST on certain sectors leading to a recalibration of advertising strategies.

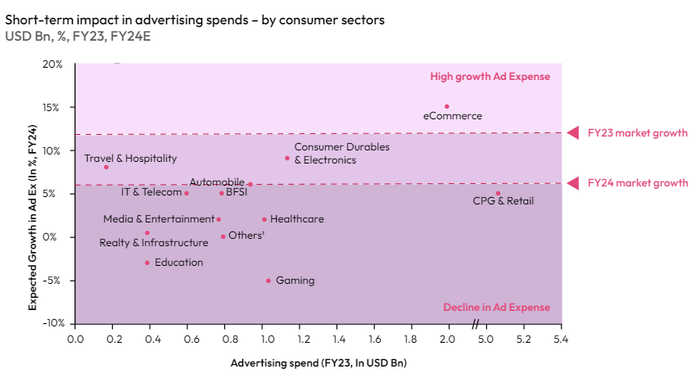

Sector-wise analysis

- eCommerce resilience: Despite a slight slowdown, eCommerce remains the most resilient sector in terms of advertising spending growth.

- Digital advertising spend distribution: Retail-led sectors dominate advertising expenditure, with eCommerce accounting for a significant portion.

- Offline sector transition: Largely offline sectors leveraging digital advertising to bridge the gap between online presence and offline operations.

Future outlook

- Projected growth: Despite a muted FY24, digital advertising is expected to witness sustained growth driven by factors such as a growing online user base and the emergence of diverse advertising platforms.

- Retail media: Retail media is emerging as a key driver of digital advertising growth, offering seamless integration of product suggestions into the customer purchase journey.

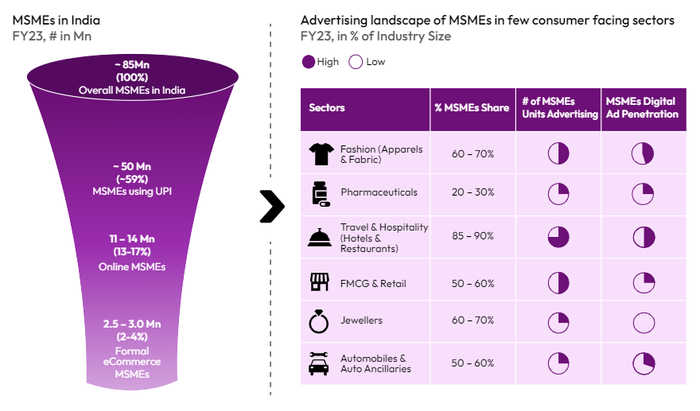

MSMEs and challenger platforms

- MSME adoption: MSMEs are increasingly leveraging digital advertising due to affordability and accessibility, contributing significantly to digital advertising spend.

- Challenger platforms: Emergence of retail media and other challenger platforms challenging the dominance of established players like Google and Meta, offering unique value propositions for advertisers.

While FY24 may witness muted growth in digital advertising spend, the sector remains resilient, driven by evolving consumer preferences, increasing digital maturity, and innovative advertising platforms. Advertisers are adapting to these changes by diversifying their advertising strategies and embracing new opportunities offered by challenger platforms.

Advertisement

14:27 IST, March 22nd 2024