Published 12:46 IST, February 4th 2024

Paytm CEO Vijay Shekhar Sharma faces arguably his biggest crisis in a race to save his digital payments firm

Advertisement

Paytm Crisis: Paytm CEO Vijay Shekhar Sharma faces arguably his biggest crisis in a race to save his revolutionary digital payments firm that had once counted Warren Buffett as a backer.

Sharma has put up a brave face even as nervous investors plundered $2 billion off Paytm's valuation after the Reserve Bank of India (RBI) ordered his banking arm to stop most of its operations from March 1 for "persistent non-compliances" and "supervisory concerns".

The ruling threatens significant business disruptions as the bank is the backbone of his home-grown payments app used by millions daily in a nation where cash was once king.

The test for Sharma, whose early days of life were one of hardship and challenges, is to keep the operations running and restore investor confidence.

His latest troubles have attracted plenty of media publicity, not least because of his rapid rise to become one of India's top businessmen, at one point moving into the country's top 100 richest club.

The executive has also found many allies in India's startup world as he often talks up their concerns, including publicly criticising Google saying its practices hurt smaller companies.

The tech business magnate described the regulatory action against Paytm as a "speed bump" this week during a conference call with analysts.

Advertisement

He held out the hope of partnering with other banks and reassured investors the Paytm app will continue to work.

The markets, however, remain sceptical of a quick resolution to the regulatory roadblock.

Paytm's valuation crashed to $3.7 billion after it lost $2 billion on Mumbai bourses this week.

Since its 2021, the Initial Public Offering (IPO) that valued Paytm at around $20 billion, the stock has now tanked 75 per cent, and analysts at JP Morgan say the company now will need to "restore credibility" of the business.

Advertisement

IPO backlash

It's not the first time the 45-year-old CEO has grabbed the headlines. Recalling the firm's 2021 IPO valuation which faced backlash from investors and analysts when the stock plummeted on debut, one startup industry executive who spoke on condition of anonymity described him as "too bombastic".

After Paytm's market debut burned many investors and critics railed against lofty valuations Security Exchange Board of India, SEBI, took steps to tighten scrutiny of IPOs.

The consumer-oriented company's rapid rise owed as much to Sharma's ambitions as to a major policy shift in Asia's third-largest economy in 2016, when Prime Minister Narendra Modi stunned markets by banning high-value currency notes overnight.

Sharma, who launched Paytm in 2009 offering mobile recharges, immediately saw the opportunities of the demonetisation move that would end up transforming the firm as the nation's premier digital payments platform.

The government decision angered many Indians who for years used cash as their main mode of payments, but Sharma took out front-page ads with Modi's photo, calling it the "boldest decision in the financial history of independent India".

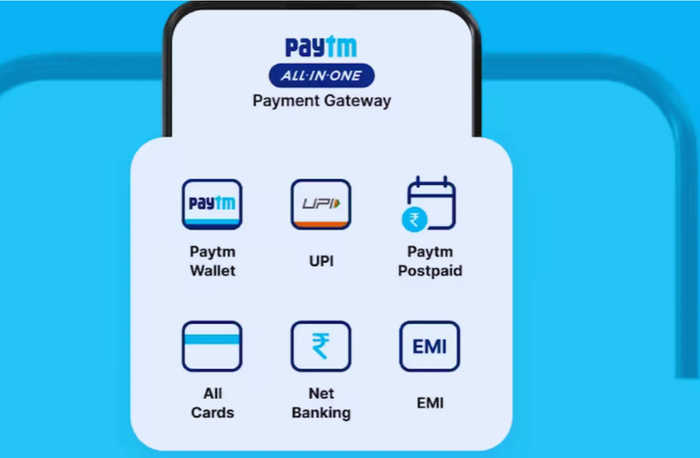

Today, with 330 million wallet accounts, Paytm has garnered widespread acceptance.

Along with its rivals like Google Pay and Walmart's PhonePe apps, many consumers use the digital services for candy payments as little as Rs 10 to purchase household items and groceries.

Advertisement

16:04 IST, February 3rd 2024