Published 19:10 IST, December 26th 2023

Private equity firm Roark Capital agreed on Aug. 24 to buy sandwich chain Subway, in a deal valuing the company at up to $9.6 billion, including debt.

Advertisement

Feeding frenzy. Restaurant operators will prove tasty morsels for acquirers in 2024. Consumer spending on dining out has recovered from the pandemic, while the worst of its inflationary after-effects are receding. That means eager sellers, like private equity owners stuck in investments during a deal rout, will finally get to serve up some sales or public listings.

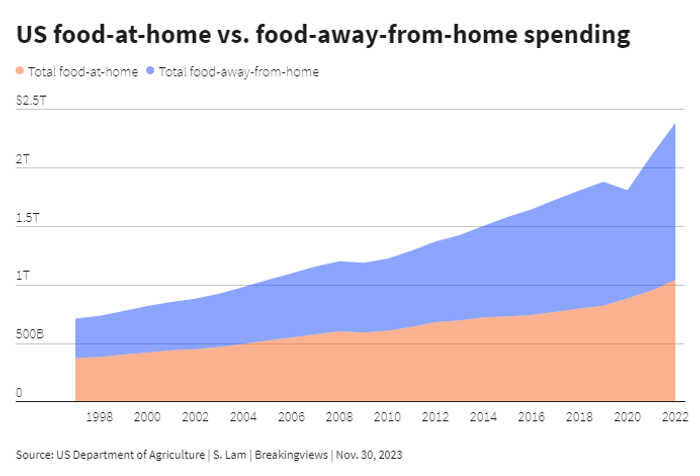

Home cooks have hung up their aprons. Spending on food away from home rose 16% year-on-year to about $1.3 trillion in 2022, U.S. Department of Agriculture data show. Restaurant sales rose for eight consecutive months through October 2023, according to a national trade group. Yet the soaring cost of ingredients, tougher access to capital and labor shortages restrained investors’ appetites.

Advertisement

That is now unwinding. After food and labor costs rose by as much as 27% in the wake of Covid-19, according to Morningstar, there is now some relief, with prices paid to producers for various food categories falling consistently through 2023 and wage inflation tumbling to less than half its peak. And despite sluggish foot-traffic growth this year, restaurateurs have held on to some pricing power, especially in fast food, where McDonald’s has boasted higher prices as its restaurants’ profitability largely recovered from 2022’s downturn.

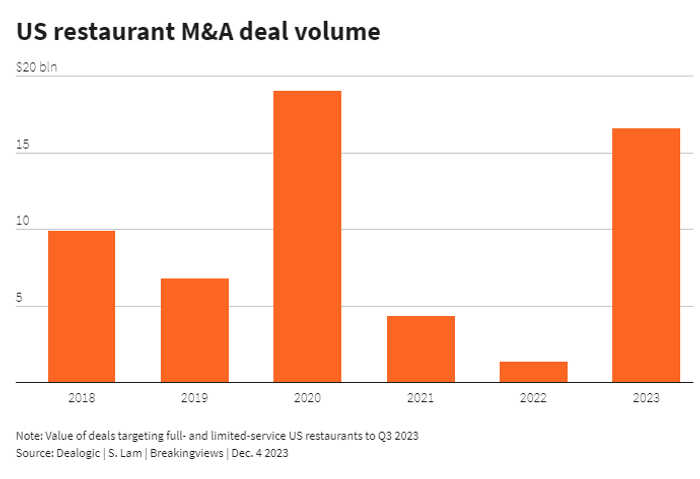

Taken together, these ingredients could form the perfect concoction for a resurgence in deals. Things are already heating up. While 2022 proved a dud, with a mere $1.4 billion in transactions, 2023 notched 12 times that figure by September, according to Dealogic data. Sandwich chain Subway finally found a long-sought $9.6 billion sale to Roark Capital in August.

Advertisement

It’s a hopeful sign for others stuck in long-held investments. Various private equity firms have rolled up a slew of restaurant brands, like Brentwood Associates’ 2013 deal for Lazy Dog Restaurant & Bar, or JAB’s 2017 take-private of Panera Bread for $7.5 billion. With interest rates topping out and markets recovering, acquirers – such as fellow buyout shops sitting on dry powder – could look to clean their plates. Or they could join the long list of companies preparing to test investors’ enthusiasm for public offerings. Panera, for instance, has filed confidentially for an IPO. That should finally give restaurant owners something to feast on in 2024.

(This is a Breakingviews prediction for 2024. To see more of our predictions, click here.)

Advertisement

Context News

Private equity firm Roark Capital agreed on Aug. 24 to buy sandwich chain Subway, in a deal valuing the company at up to $9.6 billion, including debt, subject to targets in its financial performance, Reuters reported citing people familiar with the matter. The value of U.S. deals for restaurants totaled nearly $17 billion in the first three quarters of 2023 combined, according to data provider Dealogic.

15:05 IST, December 23rd 2023