Published 10:42 IST, December 22nd 2023

Roche’s shares fell by 22% between January and late November 2023 amid major late-stage trial setbacks and a decline in demand for Covid-19 related products.

Advertisement

Swiss roll. A $440 billion Swiss drug deal may finally have the right formula. Back in 2001 Novartis took a stake in Roche, sparking speculation of a possible merger that never panned out. The companies’ divergent fortunes, however, mean that the logic of a combination is now more convincing.

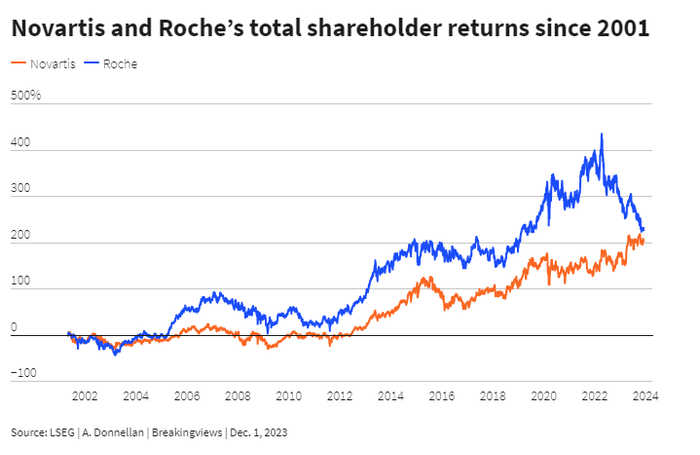

For decades Switzerland’s largest drugmakers have been close rivals and potential partners. Back in 2001, Swiss activist investor Martin Ebner, who was behind the merger that created banking giant UBS, offered his 20% voting stake in Roche to its cross-town rival, having grown frustrated with the group’s management. Roche’s outperformance in subsequent years meant the purchase worked out very well for $220 billion Novartis, which pocketed a 381% total shareholder return by the time it sold the stake in 2021, according to LSEG data.

Advertisement

The tables now appear to be turning. Novartis’s share price was up 17% between January and November 2023, thanks to success in its innovative treatments like arthritis medicine Cosentyx. Meanwhile Roche, worth under $220 billion in late November, has had a torrid couple of years given failed drug trials including a treatment for Alzheimer’s. These disappointments, along with a relatively sparse pipeline, have seen Roche lose over 40% of its market capitalisation between its peak in 2022 and late November. Newish CEO Thomas Schinecker is setting his sights on restoring the group’s pipeline, but that will be costly and take years.

Some Roche shareholders might prefer an exit. Selling to peer Novartis would allow them to pocket a premium, and a share of synergies from any combination. It would be a big bite for Novartis CEO Vas Narasimhan: a deal with even a 30% premium would value Roche at over $280 billion. But the rewards would be large too. Assume synergies equivalent to 10% of sales, and the earnings uplift could total $12.5 billion, worth a whopping $100 billion once taxed and capitalised. Moreover, buying Roche would make Novartis a leader in oncology with $22 billion of annual revenues in cancer treatments.

Advertisement

Getting such a large deal over the line will face two significant challenges. Antitrust watchdogs may want some disposals, especially in areas like oncology and neurology. And the Roche family, which controls 65% of the voting rights of the company, would need to be willing to loosen its grip. But with the company’s share price ailing, even radical treatments may start to appeal.

(This is a Breakingviews prediction for 2024. To see more of our predictions, click here.)

Advertisement

Context News

Roche’s shares fell by 22% between January and late November 2023 amid major late-stage trial setbacks and a sharp decline in demand for its Covid-19 related products. CEO Thomas Schinecker, who is keen to restore Roche’s drug development record, said on Oct. 19 that he was looking to acquire drug assets in all stages of development but that there was no rush.

17:27 IST, December 19th 2023