Updated 9 October 2020 at 19:07 IST

In Yes Bank scam, PMC bank fraud-accused Rakesh & Sarang Wadhawan of HDIL booked by CBI

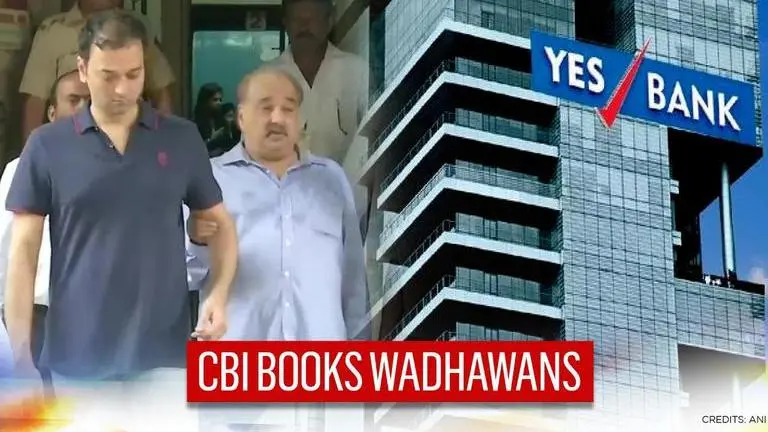

In a massive development, CBI on Friday, has booked HDIL promoters Sarang Wadhawan and Rakesh Wadhawan for alleged Rs 200-crore loan fraud in the Yes Bank case.

- India News

- 3 min read

In a massive development, CBI on Friday, has booked HDIL promoters Sarang Wadhawan and Rakesh Wadhawan for alleged Rs 200-crore loan fraud in the Yes Bank case. CBI is currently conducting searches at 10 premises including the HDIL office, Ashok Jayesh and Associates, the Wadhawans' residence and others. The duo - who are the prime accused in the PMC Bank scam - are currently in judicial custody. Rakesh Wadhawan's nephews Kapil and Dheeraj Wadhawan - promotors of DHFL are the main accused in the Yes Bank scam.

ED attaches Wadhawan's Rs 100 cr assets

Previously, the Enforcement Directorate (ED) attached three hotels owned by Rakesh Wadhawan in connection to the PMC Bank fraud. As per the press release, three Delhi-based hotels - Hotel Conclave Boutique, Hotel Conclave Executive, Hotel Conclave Comfort (FAB Hotels) owned by Wadhawan and others amounting to Rs 100 crores, have been attached. Apart from PMC Bank fraud, Sarang Wadhawan has also been arrested by Mumbai police's Economic Offences Wing in connection with a Rs 1,034-crore scam in the redevelopment of the Goregaon Patra Chawl redevelopment project.

Yes Bank scam & PMC scam

Yes Bank started facing a crisis as it accumulated many bad loans in 2018 by lending to corporate defaulters such as DHFL, Jet Airways, and Cafe Coffee day, among others. Moreover, when RBI refused to extend the term of founder Rana Kapoor as chief executive in 2018, its management was severely hit with his successor Ravneet Gill managing to raise only one round of funds through a share sale to institutional investors. Currently, the CBI and ED have been investigating several investors including Kapil and Dheeraj Wadhawan, who had received loans from Rana Kapoor. Meanwhile, Yes Bank has been restructured by the RBI with SBI as a major stakeholder at 48.21%.

Advertisement

On the other hand, RBI took control of the government-run Punjab and Maharashtra Cooperative (PMC) Bank bank on September 21, 2019, capping withdrawals. After the takeover, PMC Bank had admitted that one large account-Housing Development and Infrastructure Ltd (HDIL) was the sole reason for the present crisis. DIL directors Sarang Wadhawan and Rakesh Kumar Wadhawan were arrested by the Mumbai Police's Economic Offences Wing and the ED in connection with a fraud of over Rs 4,355 crores. PMC Bank officials gave loans to HDIL between the year 2008 and August 2019 despite not paying the previous loans. RBI has extended the moratorium till December 2020 limiting withdrawals to Rs 1 lakh, as no plan of restructuring has borne fruits yet.

Advertisement

Published By : Suchitra Karthikeyan

Published On: 9 October 2020 at 19:07 IST